Key Takeaways:

- Canada’s Indo-Pacific Strategy (IPS) provides new resources for Canadian companies to expand their investment and trade ties to the Indo-Pacific.

- Since the launch of the IPS, two-way investment between Canada and the Indo-Pacific has marginally increased, with the majority of investment happening in the first few months of 2023.

- Southeast Asia’s investors have been leading investors in Canada, with Singapore and Indonesia ranking among the top five largest investors in Canada.

- The agriculture and forestry industries benefited the most from greater Canada-Asia trade and investment.

As we mark one year since the release of Canada’s Indo-Pacific Strategy (IPS) in November 2022, it is an opportune time to review the current two-way investment between Canada and the region. Foreign direct investment (FDI) is an important component of one of the IPS’s central strategic objectives, namely, to expand trade, investment, and supply chain resilience. As part of the IPS, Canada is committed to diversifying its regional economic partnerships to new markets to protect Canada’s national interests and respond to instances of growing protectionism and economic coercion.

The release of the IPS marks the first step in advancing two-way investment relationships between Canada and the region, sending a positive signal that encourages businesses to establish new investment partnerships in the region in priority sectors. Although it is still early days in the strategy’s implementation, an analysis of the available data helps us assess whether current investment flows are putting Canada on track to meet these objectives as we wait for the full implementation of the IPS (the second step in advancing two-way economic partnerships) to unfold. This Dispatch supports that assessment by considering two questions: a) Have new and related investment ties between Canada and Indo-Pacific economies been formed since the release of the IPS? and b) Has FDI increased in the sectors prioritized in the strategy, including critical minerals and clean energy?

In considering these questions, we chart the potential impact of new initiatives and resources under the IPS on Canada-Asia investment and take stock of two-way investment flows since December 2022. Our previous research suggests that Canadian government support positively influences corporate investment decisions, especially by boosting Canada’s image as a trustworthy partner in the region.

Our preliminary analysis indicates that Canada’s two-way investment with Indo-Pacific economies has marginally increased. Our preliminary findings, based on data from our Investment Monitor from December 2022 to September 2023, indicate that Canada has been successful in diversifying its investment partners. For example, it attracted investment from several Southeast Asian economies, led by Singapore and Indonesia. The data on sectoral diversification, however, indicate that the businesses have yet to make significant investments in the industries identified under the IPS, with finance alone dominating two-way investment flows during this period. Nonetheless, we find that the sectors highlighted in the IPS have received several significant investments, and we expect that more new investments will be made in these sectors in the near future.

The federal government has announced significant project funding to strengthen economic linkages with the region. These new initiatives and resources represent more than C$244M and are spread across nine areas related to trade, with some provisions directly relevant to investment promotion (Table 1). Funded initiatives like the new Trade Gateway in Southeast Asia and numerous trade missions to the region, and enhancements to CanExport can all be leveraged to support Canadian businesses. As Table 1 illustrates, closer trade and economic ties may also drive investment between Canada and Indo-Pacific economies.

Sectoral initiatives, such as the agri-food office, innovation partnerships, and natural resource partnerships, can positively influence investment in natural resources, agriculture, and technology. Moreover, initiatives under the IPS aiming to set the same set of standards will make it easier for businesses to engage in trade and build investment ties with the region.

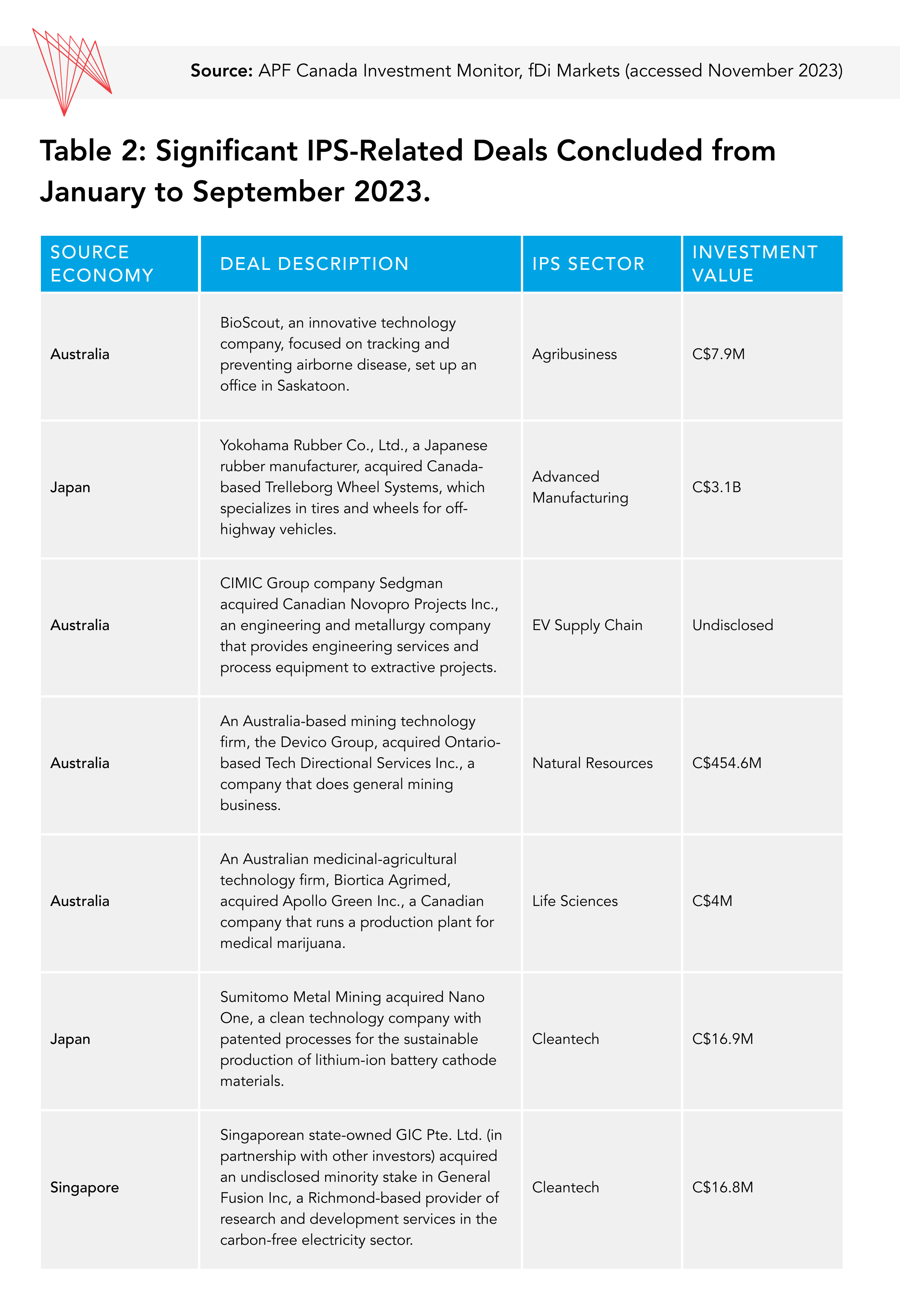

Based on these initiatives, we expect that, as the implementation of the IPS continues, Canada will diversify its regional investment partners. We also expect that sectors that benefit from additional funding, such as agriculture, natural resources, and technology, may attract more investment than sectors not identified in the strategy. Furthermore, we anticipate that Asia Pacific investment may increase in sectors promoted by Invest in Canada, an official investment attraction agency designed to support international investors in Canada. The industries highlighted by Invest in Canada – agribusiness, advanced manufacturing, cleantech, electric vehicle (EV) supply chains, life sciences, natural resources, and technology – complement sectors identified in the IPS, giving us greater confidence in our prediction that agriculture, natural resources, and technology may see growth in investment. In interpreting our findings, it is important to note that some of the investments that we discuss below were proposed before the launch of the strategy and that it will take time for investors to respond to new initiatives.

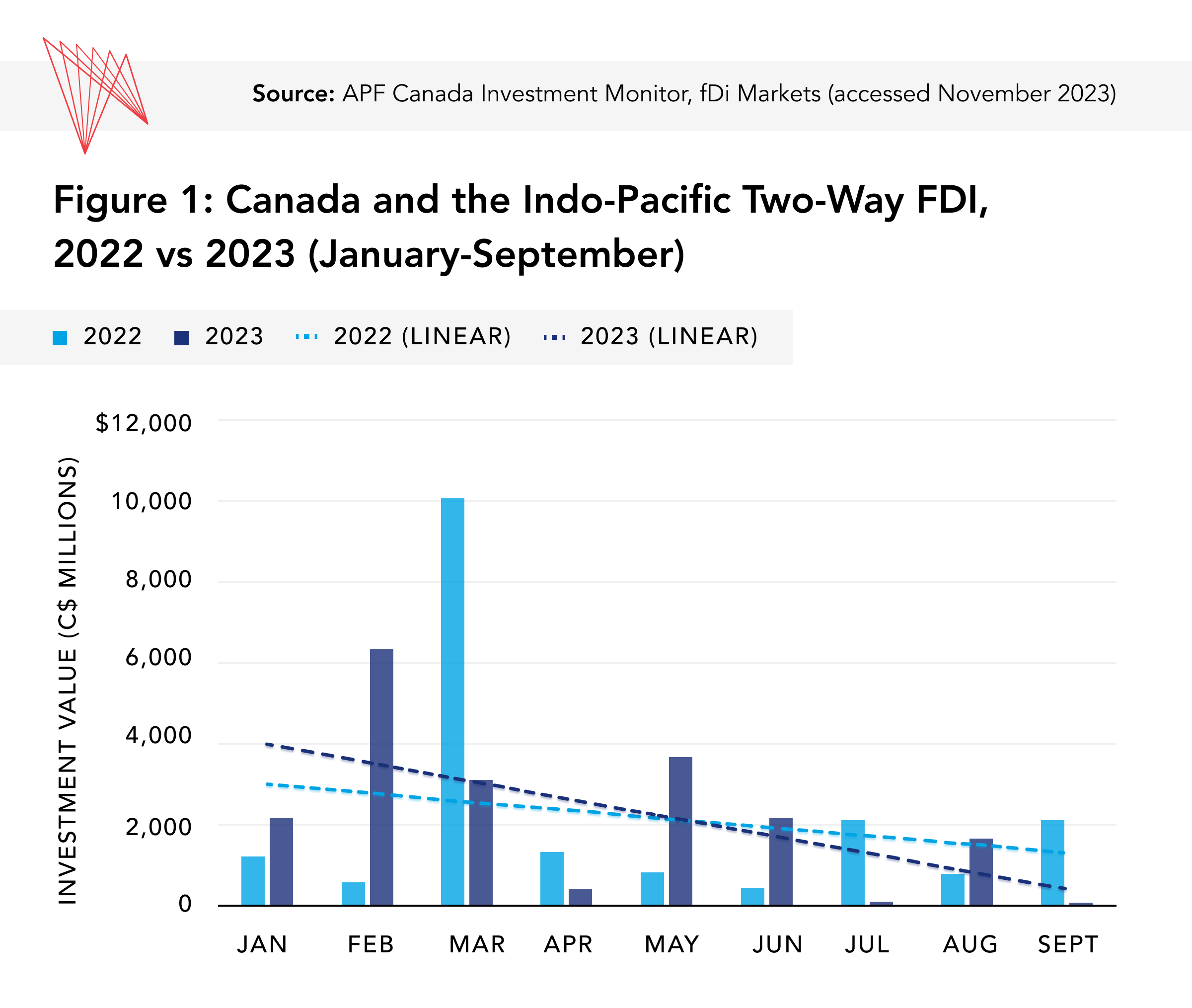

Since the launch of the IPS, there has been a small increase in two-way investment between Canada and the Indo-Pacific, with the majority happening in the first few months. Comparing two-way investment flows from January to September 2022 (pre-IPS) to investments made from January to September 2023 (post-IPS), we see marginal investment growth, from C$19.5B in the 2022 period to around C$19.8B in the 2023 period (Figure 1). Between January and September of 2023, around 85% of the two-way investment volume was generated by Asian investments in Canada, compared to around 44% generated by inward investment in 2022. After an initial increase in investment, the two-way investment between Canada and Asia, after peaking in February 2023, generally declined from March to September 2023 (Figure 1).

Although bilateral investment in 2023 has increased marginally from the previous year, it remains significantly lower than the C$51B invested in 2021, indicating that the IPS has yet to impact corporate investment strategies. Potential factors for the slow growth in investment include, but are not limited to, a lack of specifics around the implementation of the IPS policies, exacerbated by weak global economic growth, inflation, and high interest rates.

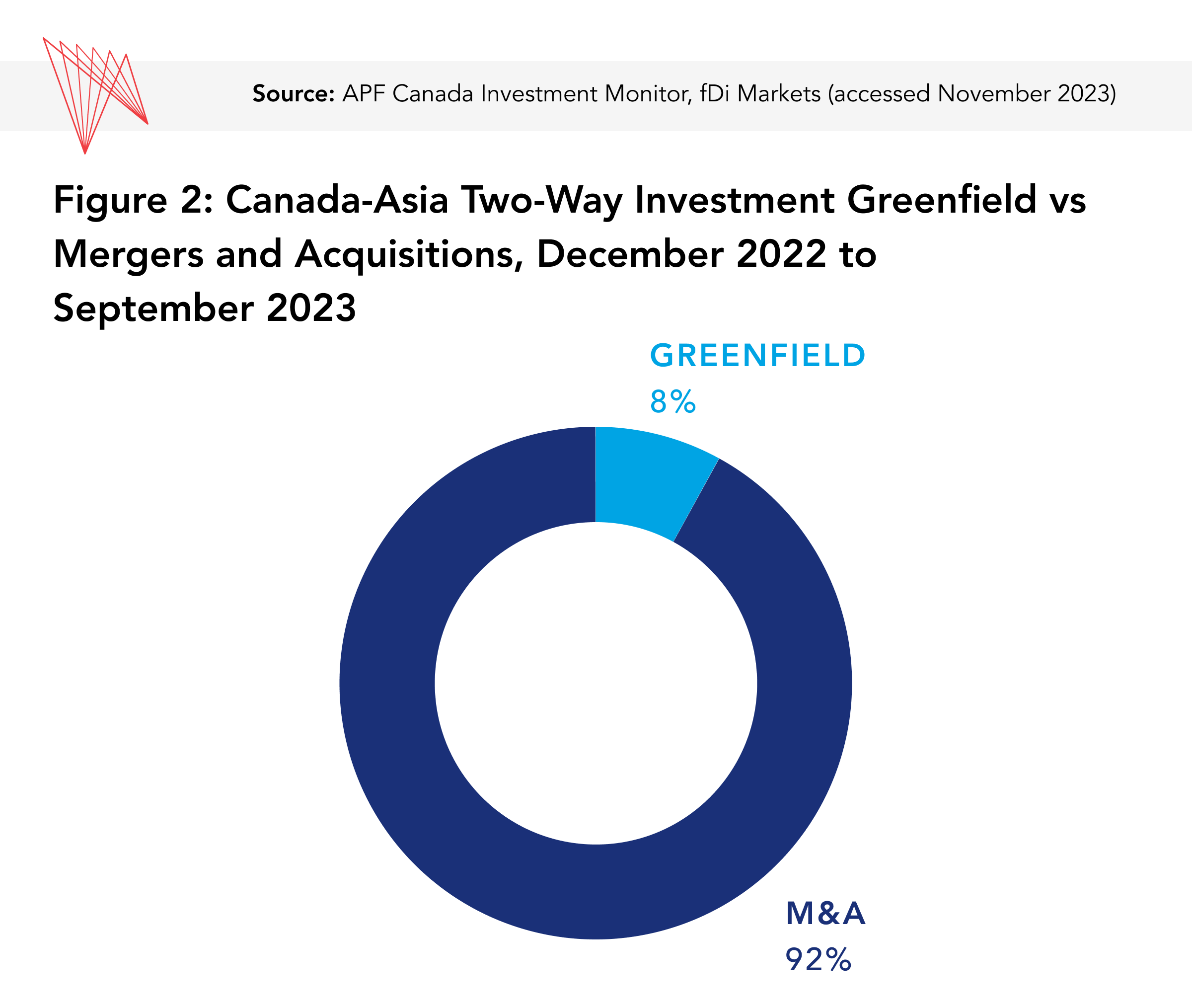

Since the launch of the IPS, mergers and acquisitions (M&As) have been the dominant type of investment in two-way FDI between Canada and Asia. Between December 2022 and September 2023, C$22.4B was invested through M&As, more than 10 times the C$2.1B invested through greenfield deals (Figure 2). Investment in greenfield projects and M&As has traditionally been more balanced, with greenfield investments comprising 47% of investment between 2003 and 2022. The preference for M&A investment exists for both outward and inward Canada-Asia Pacific investments; however, there has been significantly greater inward investment to Canada than outward investment to Asia since the start of the IPS, as noted above.

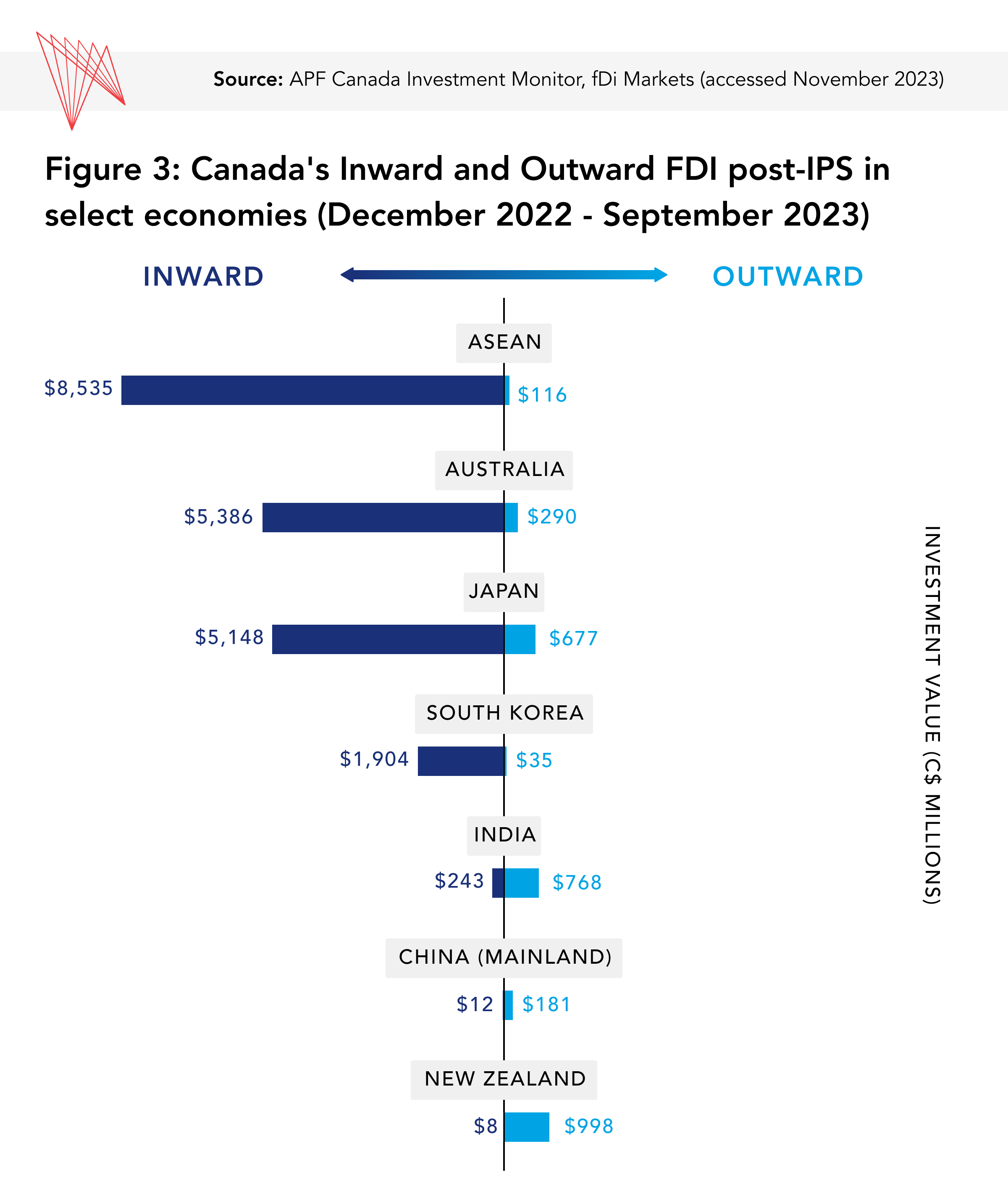

Expansion of business partnerships was led by Southeast Asian investment into Canada. From December 2022 to September 2023, member economies of the Association of Southeast Asian Nations (ASEAN) became Canada’s biggest Asia Pacific investors (Figure 3). Specifically, Canada attracted substantial investments from Singapore (C$6.2B) and Indonesia (C$2.1B), as well as smaller scale but still notable investments from the Philippines (C$183M) and Thailand (C$7M). Compared to previous years, the December 2022 to September 2023 period saw ASEAN’s largest investment in Canada, with the exception of the same period in 2018, when Malaysia’s Petronas, as part of a consortium of companies, invested significantly in an LNG export facility, LNG Canada, in British Columbia. To establish closer investment relations with other Southeast Asian economies, such as Brunei and Cambodia, the IPS must provide more opportunities for engagement, as there have been no notable investments from or to these economies since the launch of the IPS.

Canada’s traditional partners and allies in Asia have also been integral to early progress in meeting the IPS’s objectives on trade, investment, and supply chain resilience. Japan, which the IPS identifies as Canada’s key strategic ally and sole G7 partner in the region, is the third-largest recipient of Canadian investment in the region and the third-largest regional investor in Canada, investing C$5.1B from December 2022 to September 2023, a notable increase compared to Japan’s investment of C$462M from January 2022 to September 2022. South Korea, identified as another important Canadian ally in the IPS, is the fifth-largest investor in Canada, investing C$1.9B over the past 10 months, signalling a strengthening of bilateral investment relations. Canada also continues to maintain strong relationships with its Commonwealth partners in Oceania. New Zealand was the largest recipient of Canadian investments in the Asia Pacific during this period, receiving almost C$1B, while Australia retained its status as a vital bilateral partner for Canada, marked by substantial inward (C$5.4B) and outward (C$290M) investments.

Canada’s growing investment relations with Singapore, Indonesia, and India signify a geographical reorientation and diversification away from Canada’s preferred investment destinations in the region. For example, we observe a continued decline in Canada-China investment. China’s investment in Canada dropped from C$124M, invested from January 2022 to September 2022, to C$12.7M, invested from January 2023 to September 2023. Nonetheless, China remains an important destination for Canadian investors (Figure 3). In diversifying away from China, Canadian investors are increasing their investments in India, which was the second-largest recipient of Canadian investment in the region from December 2022 to September 2023. As Canada diversifies its regional partners, Taiwan and Sri Lanka have also increased their investments in Canada. Canada-Taiwan investment flows are expected to expand following the recent completion of negotiations on a bilateral foreign investment promotion and protection arrangement, provided the agreement comes into force in 2024. Based on the economies identified as Canada’s key regional partners, we expect that South Korea and emerging economies in Southeast and South Asia will become Canada’s dominant investment partners in the region.

Top corporate investors from the Asia Pacific showcased the diversity of partnerships that Canada has created with regional economies. Since the IPS’s launch, Canada has attracted large-scale investments from companies based in Singapore, Australia, Japan, Indonesia, and South Korea, in that order. Singapore’s Government of Singapore Investment Corporation (GIC) and Dream Industrial REIT, a state-owned investment vehicle, acquired Markham-based Summit Industrial Income REIT in 2023 in a deal worth over C$5.9B. The remaining top four investors in Canada from the region were Rio Tinto (Australia), Furukawa Group (Japan), PT Sinar Mas Group (Indonesia), and Naver (South Korea).

Canadian pension funds and financial institutions have remained the largest investors in the Asia Pacific since the launch of the IPS in November 2022. The Ontario Teachers’ Pension Plan was the largest investor in the region, investing C$915M in New Zealand’s communications sector. Sun Life Financial and BC Investment Management Corporation are the other two large-scale investors, with investments in Japan worth around C$510M and India worth approximately C$290M, respectively. Richmond-based Flying Fresh Air Freight cargo, which invested in India, and Burnaby-based Creation Technologies, which invested in China, also ranked among the top five investors.

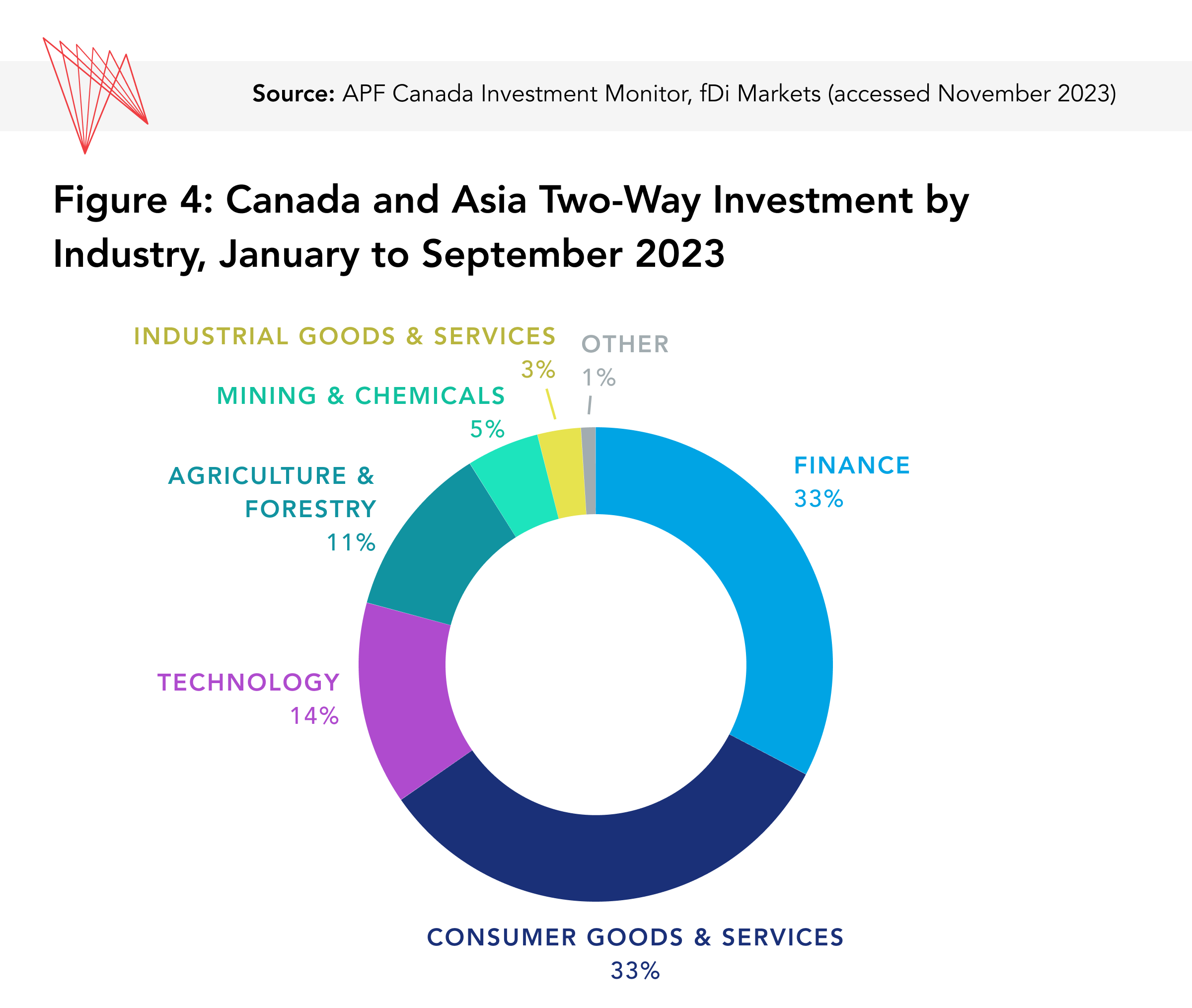

The agriculture, natural resources, and technology industries have benefited from greater Canada-Asia trade and investment engagement since the launch of the IPS. From January 2022 to September 2023, Canada attracted substantial investment in finance (accounting for 36% of total Asia Pacific investment in Canada), consumer goods and services (34%), agriculture and forestry (13%), technology (10%), and mining and chemicals (5%) industries. During this period, Canada also made substantial investments in the Asia Pacific’s technology (accounting for 35% of Canada’s investment in the region), consumer goods and services (27%), finance (16%), industrial goods and services (11%), and agriculture and forestry (6%) industries.

Looking at two-way investment, four industries dominated in 2023: finance, consumer goods and services, technology, and agriculture (Figure 4). Two of these – technology and agriculture – were highlighted in the IPS. Comparing this data with the data for January 2022 to September 2022 two-way investment volumes, we see that the finance, consumer goods and services, and agriculture and forestry industries received more investment from January 2023 to September 2023 compared to the same period in 2022, with the other industries receiving lower investments than in 2022. While it is too early to evaluate the success of the IPS in attracting more investment in a set of targeted industries, we see notable investment in agriculture, technology, and clean technology.

Notably, several significant Asia Pacific investments were aligned with sectors identified in the IPS and by Invest in Canada (e.g., agribusiness, advanced manufacturing, electric vehicle supply chains, natural resources, life sciences, cleantech, and technology). Although Canada has attracted investment in the agribusiness, electric vehicle supply chains, and life sciences sectors (Table 2), the quantity of investment in these sectors has been relatively minor thus far in comparison to other sectors. In brief, investment potential between Canada and the Asia Pacific remains largely untapped, but that could change depending on how well the IPS’s objectives are pursued.

The announcement of Canada’s IPS has unleashed an array of resources and support for Canadian companies interested in doing business in the Indo-Pacific and companies from the that region that are interested in investing in Canada. From the investment-promotion and investment-attraction initiatives outlined in the IPS to the current work being done on free trade and investment agreements with regional economies, the Government of Canada is paving the way for Canadian companies to diversify their investment partnerships.

Our Investment Monitor data suggests that since the strategy’s launch, Canada-Asia two-way investment has held steady at around the same values as in 2022, with investment declining in the latter months of 2023, possibly reflecting the downward economic pressures driven by continued inflation and persistently high interest rates. At the same time, in the period immediately after the strategy’s announcement, diversification in Canada’s investment partners grew, with ASEAN economies increasing their investment in Canada and displacing Australia as a dominant investor, a position Australia held for the previous two years.

Our data also indicates that the IPS’s sectoral focus is not yet reflected in investment flows. In 2023, two-way investment between Canada and the region was dominated by the financial industry and the consumer goods and services industry, which replaced mining and chemicals, and technology, which dominated investment flows in 2022. Nonetheless, Canada has welcomed significant investments in its critical mining sector from Australia and in EV battery manufacturing from South Korean companies. This Dispatch provides a preliminary analysis of the 2023 two-way investment flows between Canada and Asia Pacific. We conclude by noting, however, at the time of writing, more deals were being negotiated and concluded, which will be featured in our annual Investment Monitor report on 2023 investment data, to be published next year.