Taiwan’s heavy reliance on imported energy is a glaring national security risk, especially as tensions with China continue to rise. The island’s domestic energy production is negligible — currently, domestic sources account for only about three per cent of its energy consumption, a predicament made worse by a 2016 decision to phase out the use of nuclear power.

Taiwan depends on imported oil, coal, and natural gas, much of it shipped through sea lanes susceptible to disruption, especially the South China Sea and Taiwan Strait. China could readily exploit this Achilles’ heel by imposing a naval blockade; in 2022, Beijing conducted a military drill explicitly targeting the island’s oil-importing ports — Keelung and Kaohsiung. If Beijing were to target these ports or some other aspect of Taiwan’s import capacity, not only would the effects on Taiwan be devastating, effectively crippling its economy and its ability to defend itself, but it would also have much wider repercussions, given Taiwan’s centrality to global supply chains.

To reduce its energy insecurity, Taiwan is boosting its supply of renewables by diversifying its energy partnerships and bolstering its ability to produce more energy domestically.

Canada, as a global leader in clean energy, is well-positioned to support these ambitious goals while advancing its own climate ambitions and deepening its Indo-Pacific energy ties. Specifically, it can partner with Taiwan on developing capacity in two types of clean energy: offshore wind power and hydrogen, both of which are at the forefront of global decarbonization efforts.

Taiwan’s Precarious Energy Position

A significant portion of Taiwan's current energy imports comes from politically volatile regions. For instance, nearly 60 per cent of its crude oil, the island’s primary energy source, originates in the Middle East, particularly Saudi Arabia (31.2%) and Kuwait (17.8%). The vulnerability of these shipments is amplified by having to transit through chokepoints in the Strait of Hormuz, which is facing a potential blockade. Taiwan’s coal imports, meanwhile, increasingly come from Russia — the share of its coal imports from Russia has tripled in the past decade to 12 per cent, a clear risk given Russia's close ties with China. Moreover, Taiwan’s energy stockpiles are scant: it has a meagre 11 days’ worth of natural gas, 39 days of coal, and 146 days of oil. A maritime blockade by China could paralyze Taiwan's economy within weeks.

Some of Taiwan’s domestic policy decisions have further eroded its energy autonomy. It was once a regional leader in nuclear power; in the mid-1980s, Taiwan generated roughly half of its electricity needs through its three nuclear power plants. However, high-profile nuclear accidents such as the 1986 Chernobyl disaster and a controversy over a local nuclear waste facility increased anti-nuclear sentiment on the island. Taiwan's Democratic Progressive Party (DPP), formed in 1986, capitalized on this sentiment, helping the party distinguish itself from the incumbent Nationalist Party, or Kuomintang (KMT).

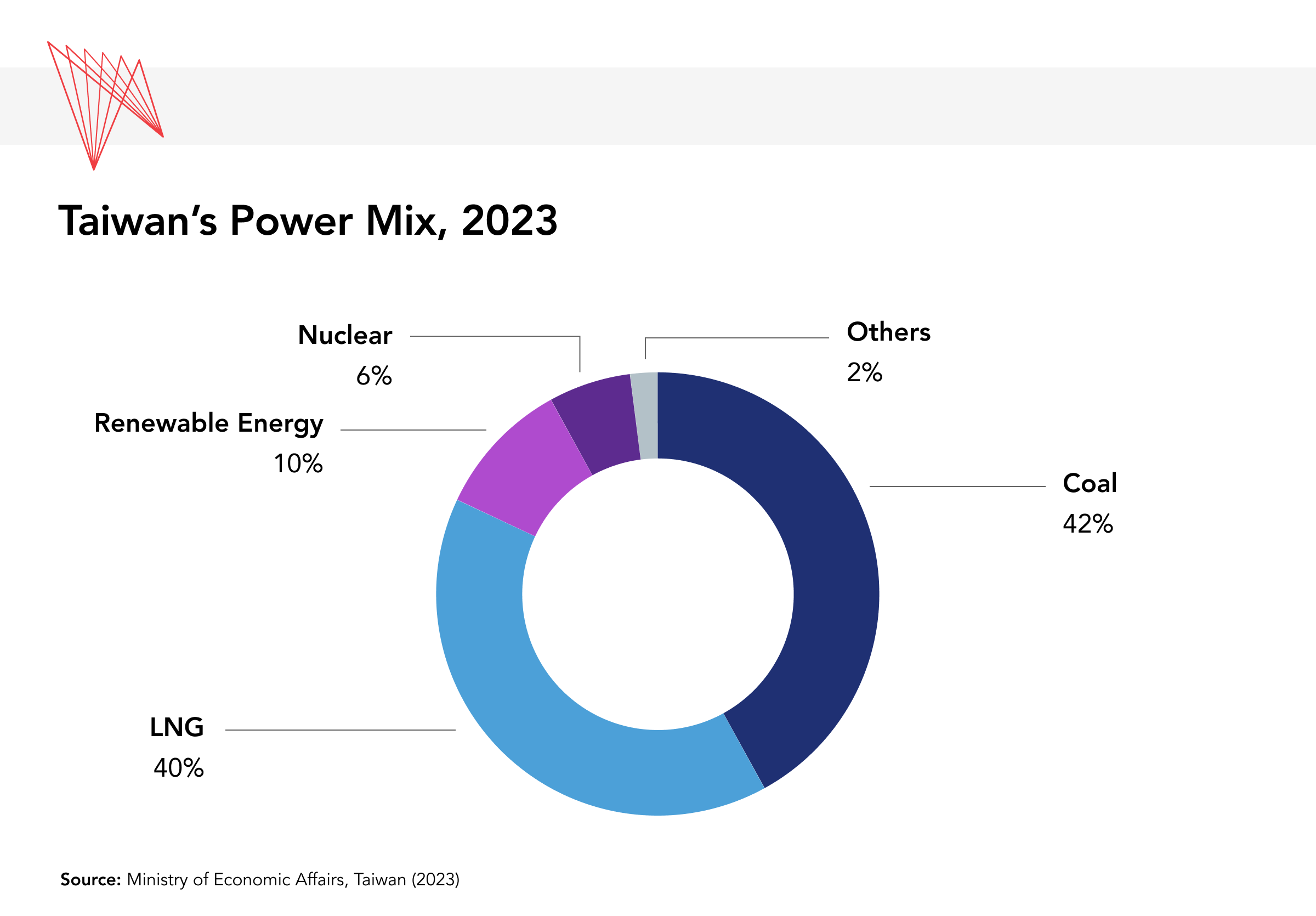

When the DDP regained power in 2016, it pursued a "nuclear-free homeland" policy of phasing out all nuclear reactors in Taiwan by 2025. Taiwan's nuclear power generation now comes from just two plants that provide six per cent of its electricity. The nuclear-free policy has created an energy gap largely filled by imported liquefied natural gas (LNG), thereby deepening Taiwan's import dependence.

To fill the yawning energy gap, Taiwan’s government, under former president Tsai Ing-wen's "Energy Transition Policy," set an ambitious 2025 energy mix target of 20 per cent renewable energy, 30 per cent coal, and 50 per cent LNG. But as of 2023, renewable sources accounted for only around 9.5 per cent of electricity generation. The slow transition to renewables, combined with rising electricity demand, has led to power shortages and has renewed public support for nuclear energy. The pro-nuclear KMT, which has held a legislative majority since the January 2024 elections, is pushing to amend regulations to extend the operational lifespan of existing nuclear plants.

Taiwan’s new president, Lai Ching-te, doubled down on his predecessor’s 2016 plan to deploy 20 gigawatts (GW) of solar and over 6.7 GW of offshore wind through partnerships and domestic development policies. He pledged C$38 billion (900 billion New Taiwan dollars) by 2030 to explore advanced energy sources, creating an opening for a partnership with Canada.

Canada: A Hydrogen Powerhouse

Taiwan’s leaders have recognized hydrogen's unique properties as a versatile, low-carbon energy carrier (see Box 1), viewing it as indispensable to its carbon neutrality goals. They have set a target for hydrogen to constitute up to 12 per cent of its total energy consumption by 2050 through a two-pronged strategy to build a robust hydrogen supply chain. In the short term, Taiwan aims to team up with major international hydrogen exporters to bridge the immediate supply gap while it builds its domestic production capacity. Concurrently, Taiwan is prioritizing technological self-reliance in hydrogen production, focusing on localizing key technologies, including carbon capture, hydrogen production processes, and efficient utilization methods.

Hydrogen: The ‘Fuel of the Future’

Hydrogen is not an energy source per se, but an energy carrier. Similar to a battery, it stores energy that can be released later for various applications. To use hydrogen as a fuel requires specific processes, with two common categories: blue hydrogen and green hydrogen.

Blue hydrogen is derived from natural gas, but the process releases significant amounts of carbon dioxide. However, the deployment of carbon capture and storage technology can mitigate these emissions.

Green hydrogen is produced through electrolysis, a process that splits water (H2O) into hydrogen and oxygen using renewable energy sources such as wind and solar power. Free from greenhouse gas emissions, this method is considered the more environmentally sustainable option. Once obtained, hydrogen can be burnt directly or mixed with oxygen in a fuel cell to produce electricity and heat, powering vehicles and other industrial processes.

Canada is well-placed to support these goals. The country ranks among the world's top 10 hydrogen producers, boasting a projected annual capacity of 212,000 tonnes of green hydrogen in 2024, and is predicted to be the world’s fourth-largest producer by 2030, trailing only Australia (the largest hydrogen producer), the U.S, and Spain. According to its 2020 federal hydrogen strategy, Canada aspires to break into the top three clean hydrogen producers by 2050.

Beyond production capacity, Canada also has expertise in carbon capture, utilization, and storage (CCUS) technologies, which are crucial for mitigating the emissions associated with blue hydrogen production. As one of only three countries with large-scale CCUS facilities for both electricity generation and large-scale industrial applications, and holding 14 per cent of the world's CCUS patents, Canada can offer transferable technologies for producing clean hydrogen at relatively low cost.

Canadian companies have also gained worldwide recognition for their hydrogen fuel cell technology. Over half the world's fuel cell buses run on Canadian fuel cell powertrains, showcasing two decades of innovation. Ballard Power Systems, a British Columbia-based pioneer in this field, exemplifies the potential for Canada-Taiwan collaboration. The company is currently in discussions with stakeholders in Taiwan for the island’s first domestically built hydrogen bus.

However, hydrogen is not without criticism. "Blue" hydrogen, produced from natural gas with carbon capture, is often presented as a climate-friendly option. However, independent research reveals that actual CO2 capture rates are closer to 12 per cent, significantly lower than industry claims of 80-90 per cent. Green hydrogen offers a truly clean alternative, emitting no CO2 during production. Nevertheless, its high production cost makes green hydrogen a niche product, representing less than one per cent of global production. Taiwan, with its limited renewable energy capacity, could face challenges in scaling up green hydrogen production, as it requires a substantial and consistent supply of renewable electricity.

Offshore Wind: Shared Opportunity and Expertise

In one area — wind power — Canada has already made significant inroads into Taiwan's renewable energy sector, with investments totalling nearly C$3.2 billion over the past six years. Northland Power, for example, is leading Taiwan’s landmark 1-GW Hai Long offshore wind project, scheduled for completion in 2025. Costing C$9 billion, Hai Long will comprise 73 turbines capable of powering more than one million Taiwanese households and industrial facilities upon activation, making it one of the largest offshore wind facilities in Asia.

While Canada does not yet have any operational offshore wind farms, its extensive experience in onshore wind energy provides a strong foundation for Taiwan’s offshore development. Ranked ninth overall in installed capacity in 2022, Canada’s thriving onshore wind sector is among the world's largest per capita. Since pioneering eight wind farms in 1998, onshore wind power has expanded over 40-fold to 337 farms nationwide. This growth is expected to continue, with capacity projected to reach 18.17 GW by 2024 and 27.75 GW by 2029. The core technologies of wind turbines, including blades, generators, and control systems, share similar design principles across both onshore and offshore applications, making Canada's expertise readily applicable to Taiwan's offshore wind ambition.

Furthermore, Canadian companies are developing innovative solutions for grid stability and reliability, which are crucial for integrating large-scale renewable energy sources such as offshore wind farms. NRStor Inc.'s fuel-free and unprecedented compressed air energy storage facility, designed for integration with wind farms, can store excess wind energy and then release it during periods of high demand, mitigating the intermittency challenges of renewable energy.

In the long run, as Taiwan undergoes an industrial transformation to develop a green supply chain—particularly to bolster its domestic production of offshore wind components — Canada's energy expertise offers valuable opportunities for long-term collaboration and leveraging Taiwan's advanced manufacturing capabilities.

Navigating Turbulence

Despite the significant potential for Canada-Taiwan co-operation, such a partnership could face both geopolitical and commercial challenges. For hydrogen trade, Canada faces strong competition from regional energy exporters such as Australia, which is investing heavily in scaling green hydrogen exports and benefits from lower transportation costs due to geographical proximity. Taiwan's East Asian allies, Japan and South Korea, produce more than half of the world’s hydrogen fuel cells, representing attractive partnerships. Taiwan’s Lai has specifically expressed interest in collaborating with Japan on hydrogen initiatives.

Similarly, Taiwan's burgeoning offshore wind sector is attracting significant global investment, with more than 1,500 such investments approved in just the first eight months of 2023. This rush to invest highlights the advantage held by competitors such as Denmark, Germany, and Japan, all of which have decades of experience in building offshore wind capacity, developing mature supply chains, training skilled labour forces, and implementing cost-competitive technologies.

Another hurdle for Canada is domestic. While Canada is a top energy producer and exporter, commercializing its energy trade has always been a challenge. For example, due to limited pipeline capacity to transport oil and gas from production areas to coastal ports, over 90 per cent of its energy exports go to the U.S.

Similar bottlenecks could hamper Canada’s commercialization of clean energy if the necessary infrastructure investments are not made. Existing pipelines, storage facilities, and vehicles are primarily designed for fossil fuels such as oil and gas. Transporting clean energy, particularly hydrogen, requires an overhaul of existing value chains, from production and storage to transportation and end-use applications, which necessitates substantial investments in new infrastructure and technologies. Canada could risk missing out on the burgeoning global clean energy market, including opportunities in Taiwan, if it falls short in upgrading and expanding its energy infrastructure.

Taiwan’s Energy Security: High Stakes

Taiwan's energy security is inextricably linked to its continued economic prosperity and global technological leadership. The island's key industries, particularly its semiconductor sector, are highly energy-intensive. As global demand for AI drives an insatiable need for advanced semiconductors, Taiwan's ability to meet this demand hinges critically on addressing its energy challenges.

The stakes could not be higher, considering Taiwan currently accounts for over 60 per cent of global semiconductor production and produces over 90 per cent of the most advanced semiconductors used in critical technologies such as AI, 6G smartphones, and autonomous vehicles.

Canada, with its commitment to strengthening Indo-Pacific ties and its expertise in clean energy technologies, has a prime opportunity to deepen its collaboration with Taiwan in this crucial area. The recent signing of a Foreign Investment Promotion and Protection Arrangement, a benefit shared by only a few Western countries, not only grants Canadian energy investors a significant advantage in the Taiwanese market, but also holds symbolic importance, fostering confidence in both Canadian and Taiwanese industries to explore further collaboration. Furthermore, the Collaborative Framework on Supply Chain Resilience endorsed by both sides underscores their shared commitment to establishing secure and sustainable supply chains, further bolstering collaboration on clean fuels, renewable energy, and achieving net-zero emissions.

• Edited by Erin Williams, Senior Program Manager, Vina Nadjibulla, Vice-President Research & Strategy, and Ted Fraser, Senior Editor, APF Canada