In February 2024, a striking AI-generated video of a woman strolling through Tokyo’s neon-lit streets captured global attention. This was no ordinary promotional clip; created by OpenAI’s text-to-video model, Sora, it showcased cutting-edge AI capabilities and sparked curiosity about why Tokyo was chosen and what it might reveal about the company’s plans there.

Following the global success of ChatGPT since its launch in 2022, OpenAI rapidly expanded its operations, establishing offices in London, U.K., and Dublin, Ireland, and announcing plans to enter the Japanese market. By April 2024, OpenAI had officially opened its first Asian office in Tokyo, marking the city’s growing significance in the AI landscape.

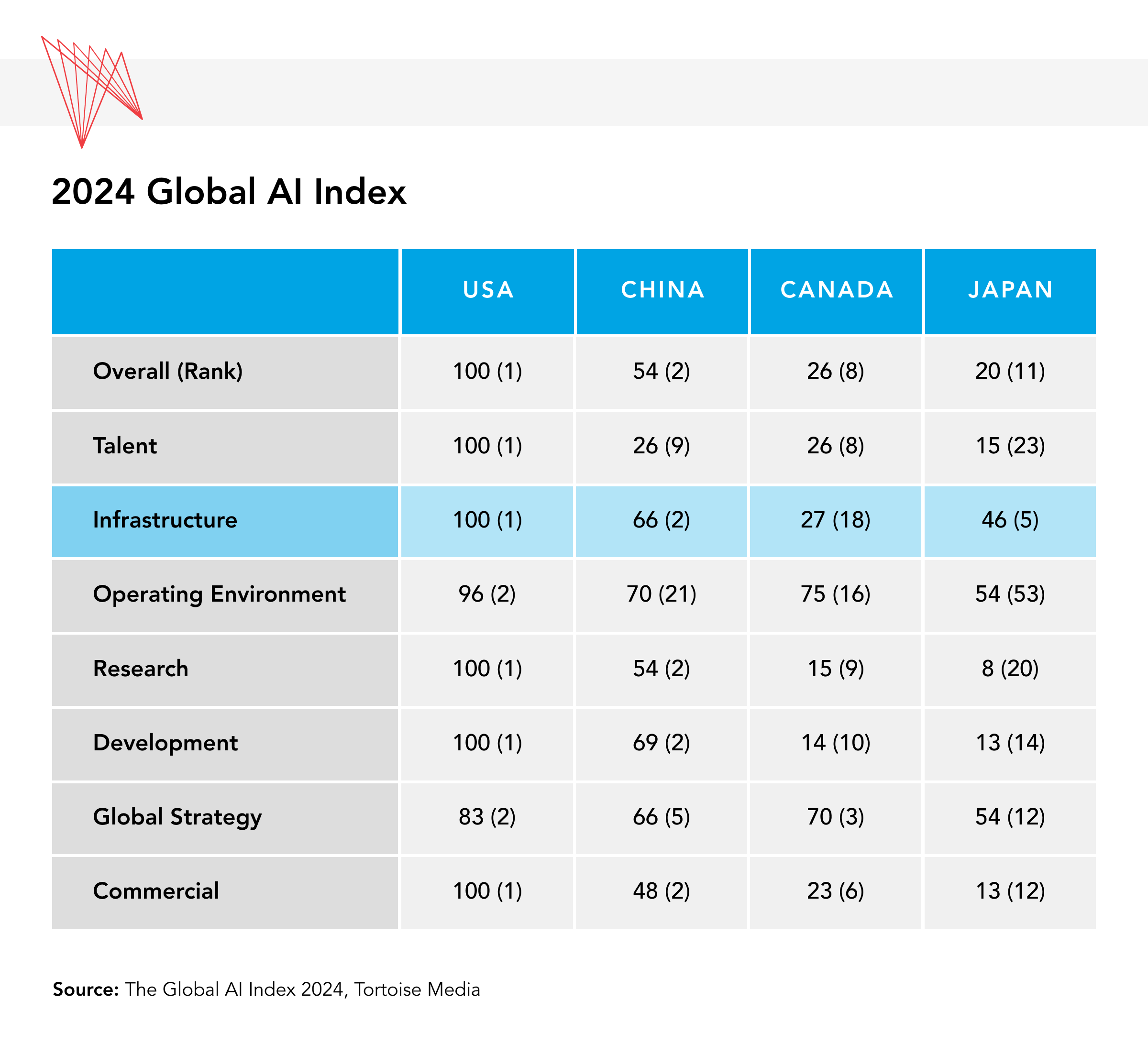

Several factors influenced OpenAI’s decision to open its first Asian office in Tokyo, including Japan’s tech-friendly business environment, strong government support for the AI industry, and its advanced AI infrastructure. These elements provide a robust foundation for large-scale AI operations and make Japan an attractive destination for global tech firms. Geopolitical factors, particularly U.S.-China tensions, also likely played a significant role. With the U.S. imposing restrictions on exporting advanced AI technologies to China, Japan offers a more stable and favourable environment for U.S. companies, further solidifying its appeal despite China’s second place ranking in the Global AI Index.

AI infrastructure refers to the foundational systems and resources that support large-scale AI operations, such as a reliable power supply, cutting-edge technologies for data centres, high-speed data transmission, and semiconductor availability. While these elements were not the only reasons behind OpenAI’s move to Tokyo, they offer valuable insights into what makes Japan an attractive location for AI firms. These aspects highlight lessons for Canada, where leadership in AI research contrasts with limited infrastructure to support large-scale, high-speed AI operations. Strong AI infrastructure not only enables the efficient deployment of complex AI models but also attracts global tech investments, driving long-term innovation and economic growth.

Japan as a Resurgent Semiconductor Stronghold

No AI system can function without the hardware that powers it, and at the heart of this hardware lie semiconductor chips. While Japan once led the global semiconductor industry, accounting for more than half of global chip production in the late 1980s, its market share had declined to less than 10 per cent by 2023. Nevertheless, the country continues to invest heavily in semiconductor production, with recent key initiatives put forward to strengthen this sector. For instance, Japanese semiconductor manufacturing companies such as Sony, Toshiba, and Mitsubishi Electric, along with other firms, recently collectively pledged to invest more than C$46 billion (5 trillion yen) by 2029 to boost their semiconductor manufacturing. While these investments are still in the early stages, they signal Japan’s continued commitment to regain its global status as a key player in semiconductor technology.

Additionally, Taiwan Semiconductor Manufacturing Company (TSMC), one of the world’s most valuable semiconductor companies, has established Japan Advanced Semiconductor Manufacturing (JASM), a majority-owned subsidiary in Kumamoto Prefecture on Kyushu Island, with a total investment expected to exceed C$27.6 billion. Supported by significant government subsidies, the venture is set to produce semiconductors from its first factory by the end of 2024 and from its second factory in Kumamoto by the end of 2027, serving the AI, telecommunications, and high-performance computing sectors. This will further enhance Japan’s semiconductor capabilities and contribute to strengthening its position in the global chip market.

The importance of a stable and advanced semiconductor industry cannot be overstated in the context of AI. These chips are the backbone of AI computations, enabling machines to process vast amounts of data at incredible speeds. For OpenAI, access to Japan’s semiconductor ecosystem means shorter supply chains, quicker development cycles, and the ability to rapidly iterate on new AI models. In an industry where time is of the essence, these advantages are critical.

Data Centres Near Major Cities

Location is everything when it comes to data centres. They need to be close to major urban areas to reduce latency and ensure quick data processing. Tokyo, as one of the world’s largest cities, provides the perfect setting for such operations. More than 80 per cent of data centres in Japan are concentrated in the Tokyo and Osaka metropolitan areas for the same reason. Being near a major metropolis not only ensures that data can be processed quickly but also allows for better integration with the local economy and other tech industries.

The Japanese government has shown strong support for the further development and expansion of data centres across the country. While the Japanese government supports the nationwide development and expansion of data centres, there is a priority to locate them near major urban areas for low latency and efficient data processing for AI. In January 2024, Amazon announced a C$185-billion (20 trillion yen) investment in AI and cloud service infrastructure in Japan, including the expansion of its two data centres within the country, followed by investments by Microsoft (C$3.9 billion) and Oracle (C$10.9 billion) for upgrading or expanding their data centres for AI and cloud services in Japan’s metropolitan areas.

This is in stark contrast to other technologically developed Asian jurisdictions like Singapore, South Korea, and Taiwan where new regulatory hurdles due to power and grid issues can make it difficult to build such infrastructure. For instance, Singapore enforces strict conditions on new data centres, citing high energy consumption and reliance on imported natural gas and water resources, while South Korea restricts new date centre developments in the Seoul metropolitan area due to grid congestion starting in 2024. Similarly, Taiwan has faced limitations on new data centres in the north, where power shortages and natural disasters pose recurring challenges. Although even in Japan, local opposition to new data centre construction has grown, as seen in Tokyo Prefecture, where residents have raised concerns about environmental impact, high energy consumption, and limited benefits to the local community. Furthermore, while constructing infrastructure is essential, the ongoing maintenance of these systems is equally demanding, with substantial resource requirements and costs that place added financial strain on both government and private companies. However, Japan has emerged as a preferred hub for data centres in Asia. This expansion of data centres also accords with Japan’s data sovereignty goals, as the government emphasizes data localization policies to protect national interests. Japan’s pro-business environment, coupled with its strategic urban planning, provides an optimal setting for data centres that need to be both efficient and close to the end-users they serve.

Japan’s Renewables and Reliable Electricity Grid for Data Centres

AI systems in data centres are notoriously energy-intensive, with some estimates suggesting a single interaction with an AI-powered chatbot can consume up to 10 times the energy required for a traditional Google search. Japan’s electricity grid, known for its reliability and capacity, provides a critical advantage for AI companies. Although renewable energy currently accounts for just over 20 per cent of Japan’s electricity production, the government is committed to increase this share significantly up to 38 per cent by 2030, with growing efforts to utilize renewable energy-rich areas like Hokkaido for AI data centres.

With ongoing investments in renewable energy, Japan is making efforts to meet the high power demands of AI data centres while pursuing global sustainability goals, though the transition remains gradual and faces significant challenges. Japan’s Ministry of the Environment is promoting renewable-only data centres, with companies such as Amazon supporting this shift. Amazon, Japan’s largest renewable-energy purchaser, has invested in a 33-megawatt onshore wind farm and a 9.5-megawatt solar farm, with plans to power all its facilities in Japan with renewable energy by 2030. Additionally, Japan is focusing on AI-driven solutions to optimize grid efficiency for AI and data centre sectors. For instance, companies such as Digital Grid are developing AI-based platforms for direct energy trading to address supply-demand imbalances, as the peak times for AI data processing and renewable energy production often differ.

Despite these efforts, Japan’s transition to renewable energy has been gradual and struggles to keep up with the rising demand from energy-intensive AI operations, highlighting concerns about the long-term sustainability of this growth. However, the combination of renewable energy expansion, AI-driven grid management, and stable power from both renewable and non-renewable sources demonstrates Japan’s commitment to provide the robust infrastructure essential for large-scale AI operations.

Japan as a Hub for Undersea Cable Systems

Undersea cables are the lifelines of global communication, carrying 99 per cent of international data. In an age where AI depends on rapid global data access, Japan serves as a critical landing point for trans-Pacific cables, linking several Asian countries and ensuring high-speed data transfer across the region and to other continents. Tokyo, Chiba, and Okinawa are key hubs for cables connecting Asia with North America and beyond. This infrastructure is crucial for maintaining the high-speed data transfer rates required by AI systems.

The C$1.36-billion project by Google to lay new undersea cables between Japan and the U.S. further demonstrates Japan’s importance for global data transfer. For U.S.-based OpenAI, proximity to these data highways offers a significant strategic advantage, enabling seamless testing and operation of their AI models on a global scale.

Government and Corporate Support for Non-Traditional Infrastructure: Policy, Human Capital, and Partnerships

Japan’s supportive regulatory approach to AI governance and data has created an innovation-friendly environment, drawing global AI leaders such as Microsoft, Nvidia, and OpenAI. Between May 2023 and August 2024, Japan’s AI Strategy Meetings focused on granting AI developers access to government-held data and facilitating generative AI growth. Japan’s national AI strategy, particularly the Hiroshima AI Process, promotes “safe, secure, and trustworthy” AI systems. This balanced approach — encouraging technological advancement while managing risks— has positioned Japan as an attractive hub for AI firms seeking to expand globally.

Japan’s international AI partnerships, particularly with the U.S., further strengthen its position. In 2023, Japan and the U.S. initiated joint efforts in AI and quantum technology, backed by a raft of major tech players including NVIDIA and Amazon. Investments such as C$34 million for joint research between the University of Washington and Japan’s University of Tsukuba also signal Japan’s commitment to advancing cutting-edge AI research. Similarly, Japan is fostering collaborations with Canada, exemplified by the Canada-Japan 3+2 initiative, which supports AI-based solutions for aging populations through joint R&D projects. Additionally, the 16th Japan-Canada Joint Committee Meeting on Cooperation in Science and Technology in 2024 highlighted bilateral efforts in AI, semiconductors, and quantum technologies, further solidifying Canada-Japan innovation partnerships.

Yet, Japan faces an aging workforce and talent shortages, which could stifle long-term innovation despite its ability to produce top-tier engineers. Japan’s AI sector also faces growing competition from other Asian tech hubs, such as Singapore, South Korea, and Taiwan, which may impact its ability to attract future AI investments.

SoftBank, a Japanese tech and telecom giant, recently made a C$688.2-million investment in OpenAI through its Vision Fund, signalling growing corporate support for AI advancements. This convergence of government backing, international collaboration, and corporate investment made Japan a prime location for OpenAI’s continued growth and AI leadership.

The Future of AI in Japan and Lessons for Canada

Despite its relatively slow digital transformation, Japan’s demand for AI services is rapidly increasing. According to the Japan Electronics and Information Technology Industries Association, domestic demand for generative AI services is expected to grow from C$1.08 billion (118.8 billion yen) in 2023 to an astonishing C$16.11 billion (1.77 trillion yen) by 2030, reflecting an annual growth rate of 52 per cent — well above the global average of 38 per cent. This surge highlights Japan’s evolving AI market and its growing appetite for cutting-edge AI solutions.

OpenAI’s decision to establish its first Asian office in Tokyo also offers crucial lessons for Canada, particularly regarding the significance of a strong AI infrastructure. Japan’s fifth-place ranking globally in AI infrastructure, compared to Canada’s 18th, highlights a notable disparity in readiness to support large-scale AI operations. Japan’s advanced infrastructure — including a reliable power supply, sophisticated technologies and equipment for data centres, and high-speed data transmission — has been key to attracting AI giants such as OpenAI. While Canada’s C$2-billion investment announcement to enhance AI data processing capacity is a positive step, it highlights the need to address foundational gaps in infrastructure, regulation, and strategic priorities to fully capitalize on AI’s potential. Without addressing these gaps, Canada risks falling behind in the increasingly competitive global AI landscape.

A second key lesson from Japan is its strategic advantage in the semiconductor industry. Semiconductors are the backbone of AI systems, and Japan’s efforts to regain chip leadership — and particularly its collaborations with TSMC — bode well for its future in this critical sector.

In contrast, Canada is heavily reliant on international chip supply chains, making it vulnerable to shortages and rising costs. To fully unlock its AI potential, Canada must explore strategies to develop or secure a stable semiconductor supply, whether through government incentives or partnerships with global industry leaders like TSMC. Without this foundational capability, Canada’s ability to sustain its leadership in AI will remain constrained.

For Canada, the public consultation held in fall 2024 on the design and implementation of the AI Compute Access Fund and AI Sovereign Compute Strategy, as well as the development of AI infrastructure, are essential to strengthening its position as a global AI leader and attracting more international AI and tech companies.

Japan’s ability to attract global tech leaders such as OpenAI demonstrates the importance of strategic infrastructure investments and a supportive ecosystem. Canada can learn from Japan’s approach in developing robust infrastructure, reliable energy solutions, and strategic research partnerships. By adopting similar strategies and enhancing its AI readiness, Canada can become a more attractive destination for global AI firms and drive long-term economic growth and innovation. The decisions made today will significantly impact Canada’s ability to compete in the global tech landscape for decades to come.

• Edited by Charles Labrecque, Director of Research, Vina Nadjibulla, Vice-President Research & Strategy, and Ted Fraser, Senior Editor, APF Canada