The Takeaway

The closure of Bangladesh's biggest coal power plant due to fuel shortages highlights various flaws in the country’s energy policy, including overpaying private sector project developers, a heavy reliance on imported fuels, and a lack of renewables and cleantech alternatives. As the country grapples with its worst energy crisis in a decade, ensuring energy security to meet Bangladesh’s ambitious goal of becoming a developed country by 2041 seems increasingly unattainable.

In Brief

As the second unit of Payra power plant stopped production on June 5 due to a coal shortage, approximately 23.4 million people in parts of Dhaka, Gopalganj, Jashore, Khulna, and Patuakhali districts braced themselves for more power cuts. The first unit of the 1,320-megawatt (MW) plant, set up by the Bangladesh-China Power Company Limited in 2018, ceased operations on May 25.

Every year, Bangladesh imports fuels worth more than C$2.6 billion (216 billion Bangladeshi takas) for power generation. The country’s energy imports were jeopardized by the Russia-Ukraine war, which, beginning in February 2022, sparked an increase in fuel prices globally and an acute shortage in foreign exchange reserves domestically, reducing Bangladesh’s capacity to import fuel.

Implications

As the South Asian economy struggles to pay fuel import bills, its national grid, despite its 23,482-MW generation capacity, can supply only 14,000 MW to 14,500 MW against a demand of 15,500 MW to 16,000 MW daily. This shortfall leads to a ‘load shedding’ of 2,000 to 2,500 MW throughout the country several times a day. These power cuts have exacerbated public suffering as the country also tries to combat the impacts of climate change, such as heat waves, and tackle soaring temperatures of 38 C to 41 C.

The energy crisis has also prompted political and economic woes. On June 8, the Bangladesh Nationalist Party (BNP), the country’s chief political opposition, held an hour-long sit-in program in front of power supply authority offices in districts across the country, protesting load shedding as well as alleged corruption in the power sector. Since fall 2022, BNP has continuously voiced concerns over high electricity prices and power outages during its election rallies.

The power cuts have disrupted several sectors, including agriculture and manufacturing. The country’s ready-made garment (RMG) industry has seen at least a 50 per cent drop in RMG production over the last year, which accounts for over 80 per cent of total export earnings for Bangladesh. Canada-Bangladesh economic ties are also dominated by textiles and apparel, and Bangladesh’s energy crisis may have ripple effects for major Canadian brands, such as Hudson’s Bay, lululemon, and Mark’s. As the energy crisis forces Bangladeshi factory owners to raise production costs and reduce output, Canadian companies might have to take their business elsewhere.

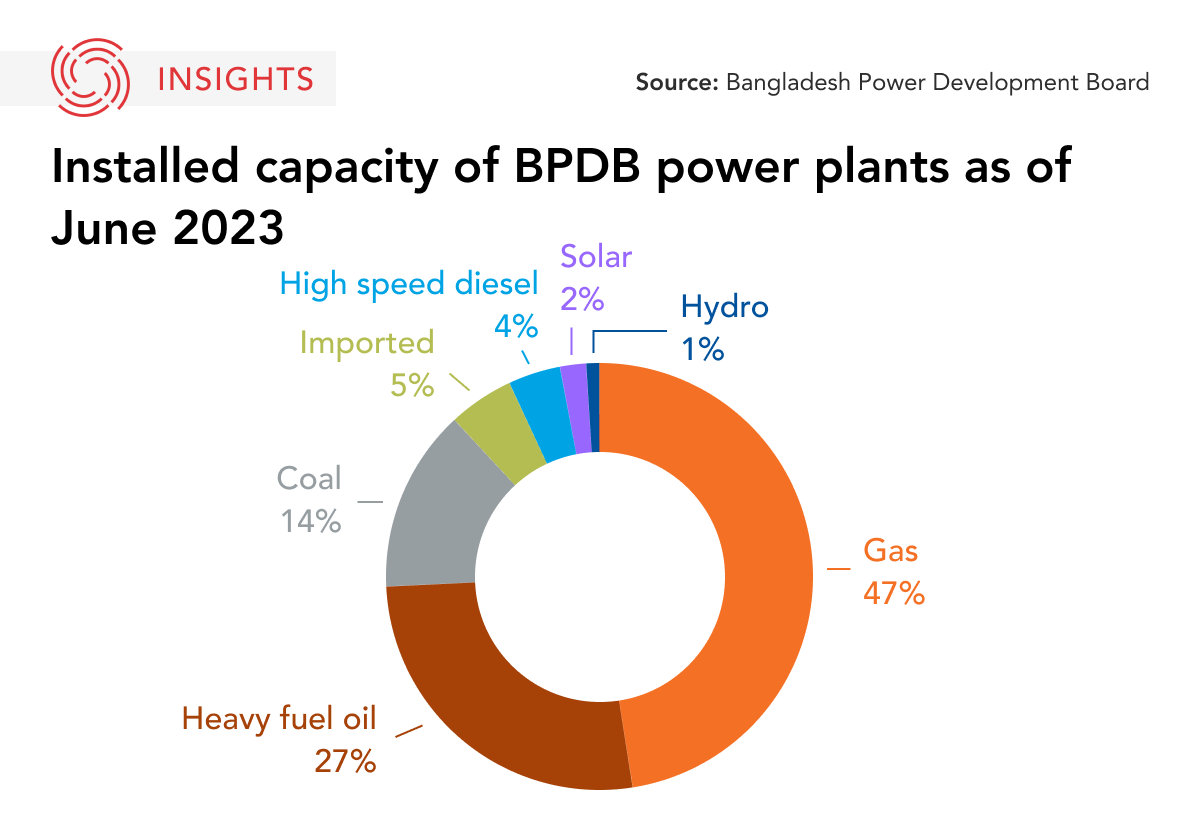

Bangladesh’s reliance on non-renewable energy sources and its hasty embrace of long-term financing deals — which often morph into debt traps — have concerned onlookers, as the deals also have detrimental environmental and social impacts. Bangladesh’s only resource, natural gas, is projected to sustain the country until 2033. As a result, Dhaka continues negotiating expensive deals to import liquefied natural gas from Japan, Oman, and Qatar, following its Power System Master Plan 2016 objectives. It has also struck non-renewable energy deals with India, China, and Russia.

As Bangladesh attempts to balance its growing population’s demand for energy and setting the pace for climate change, its renewable energy goals, which have been on the back burner for a long time, must be revived to deal with the escalating energy crisis. The country must also contend with the competing influences of India and China, as both try to gain more control over Bangladesh’s energy sector and the region.

What’s Next

- Translating rhetoric into reality

Bangladesh has set various (sometimes contradictory) targets to secure an affordable, sustainable, and secure energy supply. Bangladesh’s Mujib Climate Prosperity Plan, released in 2021, aims to reach 30 per cent renewable energy by 2030. Meanwhile, the proposed Integrated Energy and Power Master Plan, supported by Japan, aims for 17.1 per cent renewable energy by 2050. While Bangladesh has taken steps towards implementing cleaner energy sources, with plans to import hydropower and introduce the country’s first wind-powered plant, the coastal country’s growing reliance on non-renewable sources poses significant threats.

- Canadian cleantech in Bangladesh

Canada committed to collaborate with Asia Pacific countries and facilitate energy transitions in the region in its Indo-Pacific Strategy. With its cleantech and renewable energy expertise, Canada can be an ideal partner in Bangladesh’s quest for sustainable energy. According to APF Canada's Investment Monitor database, from 2012 to 2022, Canadian companies invested over C$2.2 billion in Indian renewables and the country’s cleantech sector. Bangladesh provides expansion opportunities for the Canadian cleantech sector, ensuring a larger presence in the region.

• Produced by CAST's South Asia team: Dr. Sreyoshi Dey (Senior Program Manager); Prerana Das (Analyst); Suyesha Dutta (Analyst); Silvia Rozario (Analyst); and Deeplina Banerjee (Analyst).