China and Hong Kong are the largest markets of interest in Asia for Canadian tech companies. Not surprisingly, Hong Kong is predominantly services-related. A study of Canadian tech firms in China has recently been completed in which no significant changes were found over the 2020-21 period in terms of market exits. This shows that the Chinese marketplace continues to play an important role for Canadian tech firms.

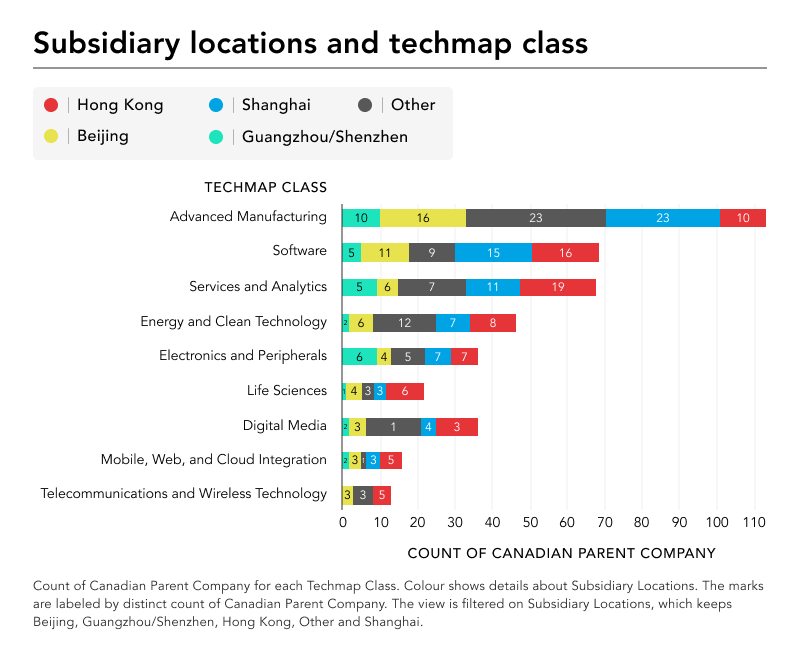

The research for this brief report focuses on 200 Canadian tech firms with 415 locations in China and Hong Kong. The graph below shows the locations of these firms by sector. Hong Kong is the largest destination, followed by Shanghai, and advanced manufacturing is the largest tech sector. However, services predominate overall, especially software and services and analytics, and this breakdown of locations and sectors has largely continued since 2015.

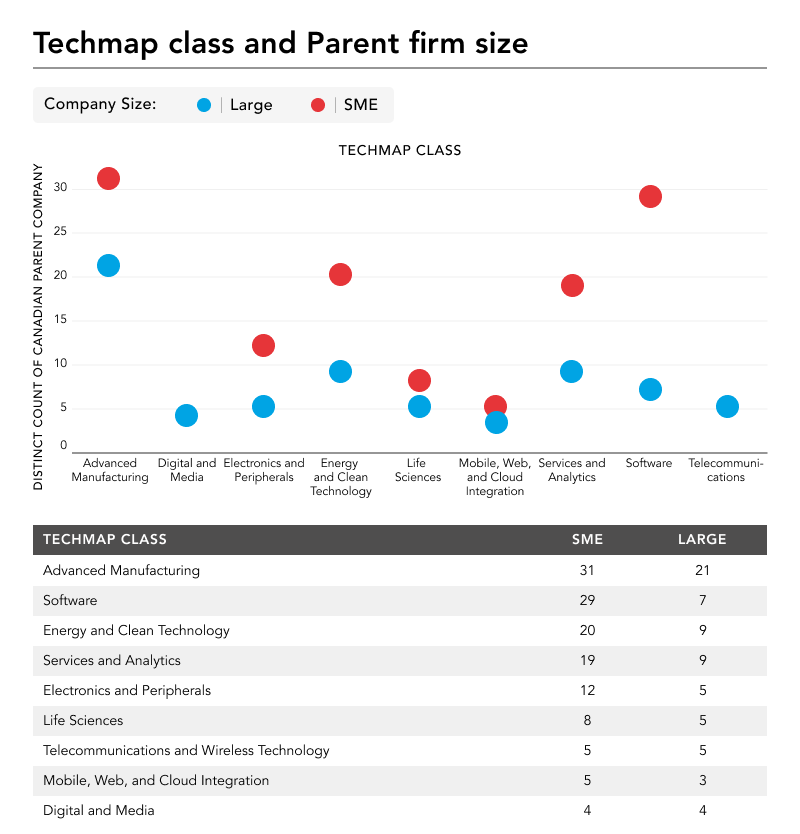

The graph below illustrates that small and medium enterprises (SMEs) dominate in most sectors.

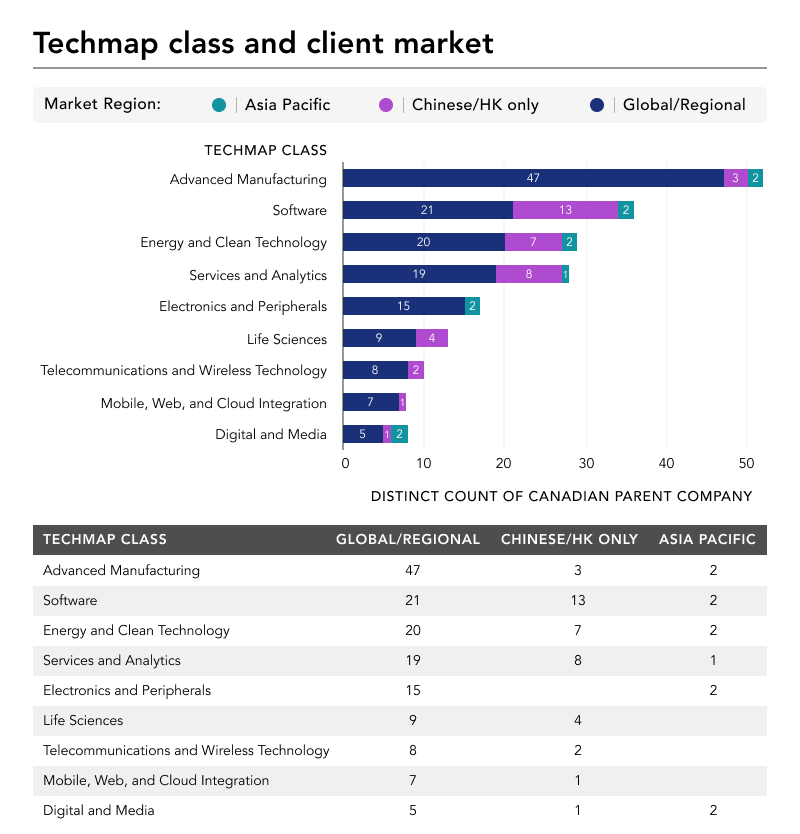

Of further interest is whether the Canadian tech firms located in China and Hong Kong also have locations in other markets. The graph below shows that most firms have subsidiaries in either the rest of the Asia Pacific or other markets and are not solely based in China or Hong Kong.

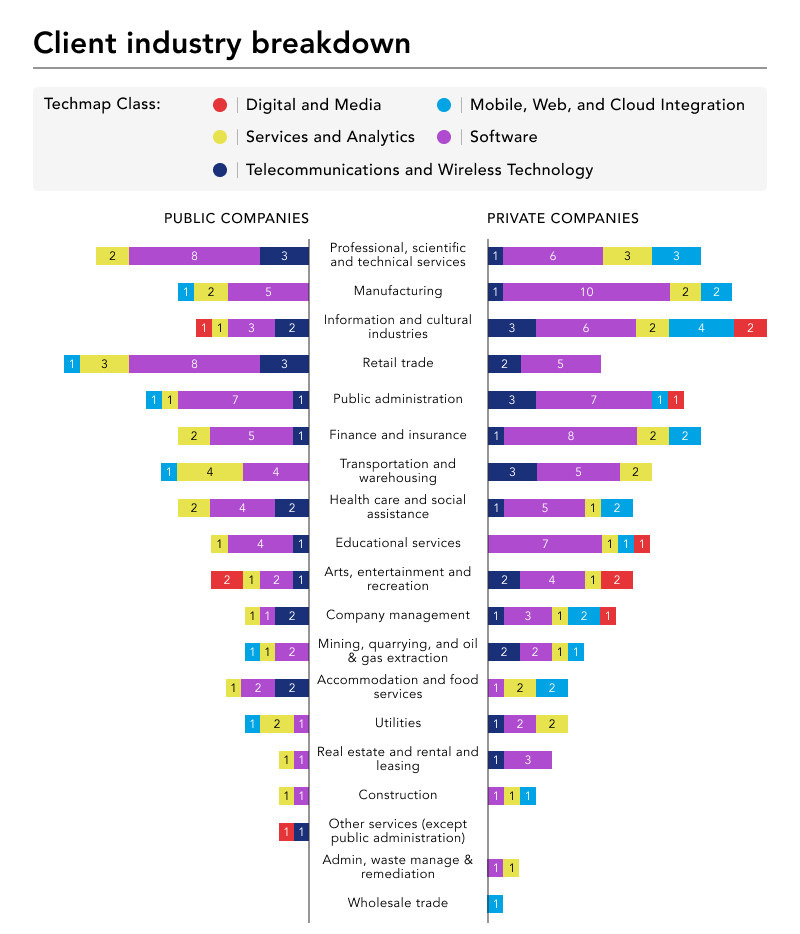

Finally, in a separate study of Canadian digital multinationals (these companies are all services-related), we determined that the clients of these Canadian tech firms are overwhelmingly other services companies, as illustrated below.

In summary, we have drawn the following conclusions from the mapping data on Canadian tech companies with locations in China and Hong Kong:

- China and Hong Kong continue to be the top destinations for Canadian tech firms in Asia, and there is no evidence of a major change in this trend in the 2020Q1–2021Q1 period;

- Services-related companies have the largest share of locations in China and Hong Kong, in particular, in the two sectors of software and services and analytics;

- SMEs dominate in most sectors, and these companies have locations in other markets, proving that companies in the digital economy do not have to be large to be globally competitive; and,

- Evidence of global services value chains: The clients of services-related digital multinationals are overwhelmingly other services companies.

The research for this project is based on data from the Munk School’s CanAsiaFootprint mapping project https://munkschool.utoronto.ca/canasiafootprint/ which currently comprises 762 Canadian companies and organizations with 2,476 locations in Asia. Additional research was undertaken for the Creating Digital Opportunity (CDO) project at the Munk School, focusing on Canada in the global digital economy.