With 34 provincial offices abroad, Quebec’s sub-national diplomacy is among the most extensive in the world. Its international priorities currently include a focus on the Indo-Pacific, captured in its 2022 Indo-Pacific Strategy, which was launched a few months before the Government of Canada rolled out its own strategy. Vice Premier Geneviève Guilbaut, noting the small size of Quebec’s domestic market, said the province needs to take advantage of political and economic developments in the Indo-Pacific, which “is emerging as the new economic and political epicentre of the 21st century.”

Quebec’s articulation of its own distinct approach to the Indo-Pacific should not come as a surprise; since the formulation of the Gérin-Lajoie doctrine in 1965, the province has pursued a foreign policy that is autonomous from Canadian foreign policy in a number of areas. What is less well known, however, is how those two strategies resonate with their respective publics.

A 2024 survey by the Asia Pacific Foundation of Canada (APF Canada) illustrates some of the similarities and differences. In brief, the survey indicates that francophone Quebecers are generally more tepid than anglophones in the rest of Canada in their desire to engage with the Indo-Pacific. It also suggests that on some issues, these two sets of views have evolved in different ways since 2018, the most recent pre-COVID benchmark available.

The results presented below are based on the questionnaire responses of 485 francophones living in Quebec (referred to here as “francophones”) and 2,959 anglophones living in provinces other than Quebec (referred to as “anglophones”) as of mid-2024. To isolate the distinct views of francophone Quebecers, anglophones residing in Quebec and francophones residing in provinces other than Quebec were excluded from the analysis.

Francophones generally less enthusiastic about trade with the Indo-Pacific

The objectives of Quebec’s Indo-Pacific strategy are, first and foremost, economic in focus, and they reflect that the Quebec government recognizes the region’s critical importance to diversifying its export markets and attracting foreign direct investments (FDI) in key sectors such as green technologies.

Despite these economic benefits, francophones in Quebec are less inclined than anglophones in the rest of Canada to want to actively partner with Asian economies. They are also more likely than anglophones to prefer to partner with traditional partners such as the U.S. and the EU. However, Canadian perspectives on partnering with the U.S. may have taken a hit due to Trump’s tariff threats. A recent poll by Ipsos for Global News indicates that nearly 70 per cent of Canadians now hold a lower opinion of the U.S. because of these tariffs.

francophones’ greater reluctance to engage with the Indo-Pacific could be due to several factors. One is the far lower level at which Quebec attracts FDI flows from that region. For example, in 2023, Ontario, Saskatchewan, and British Colombia received 90 per cent of the FDI inflows from the Indo-Pacific, while Quebec received just over eight per cent. The largest investment in the province in 2023 came from South Korea’s Volta Energy Solutions, which invested C$750 million to build a copper foil plant.

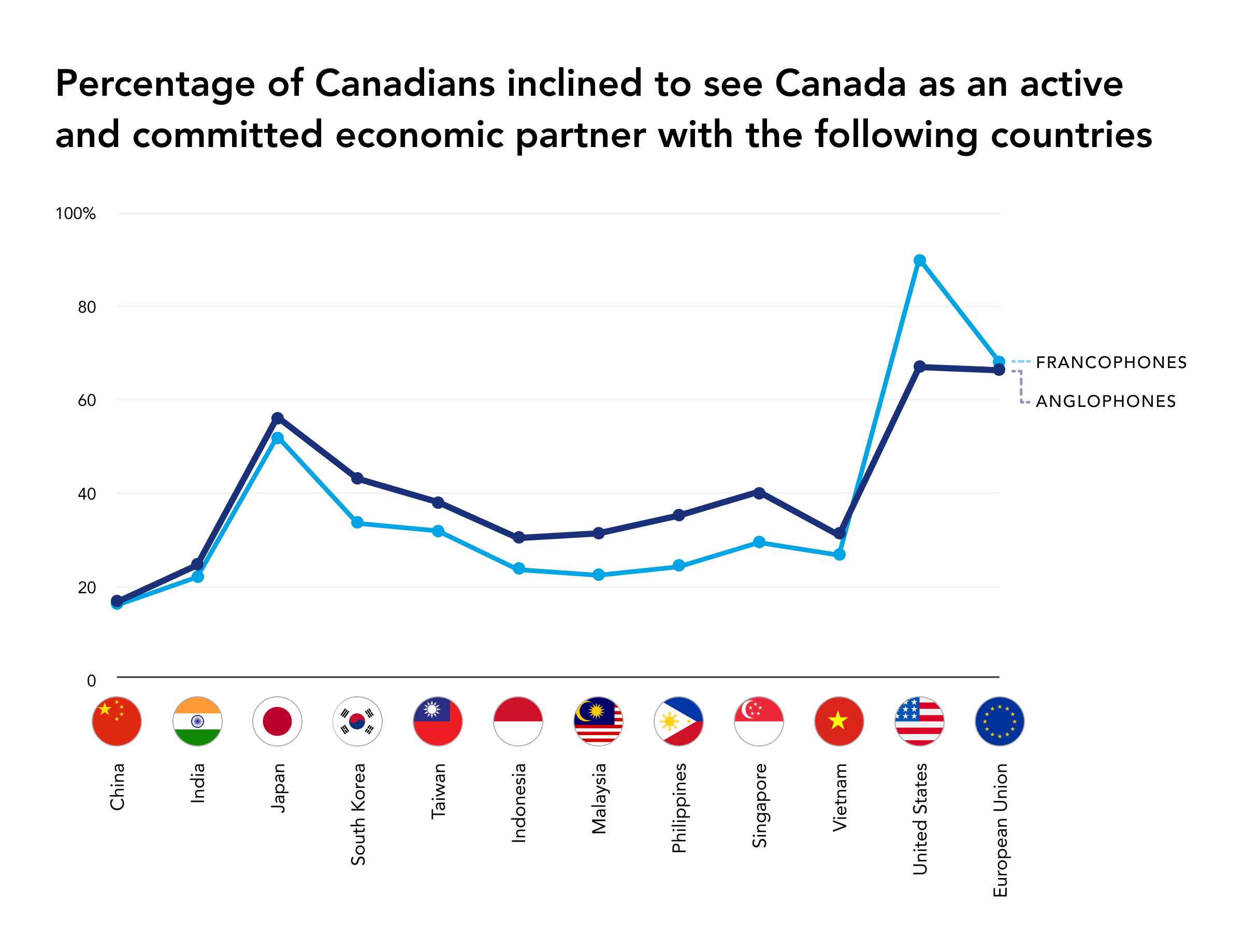

There is also some hesitancy about trade. As seen in Graph 1, Canadians approve of trading with the EU at comparatively high levels: 68 per cent among francophones, and 66 per cent among anglophones. Interestingly, as of mid-2024, there was a wider gap on trading with the U.S.: 90 per cent of francophones favoured this vs. 67 per cent of anglophones. In future polls, it will be useful to measure the impact of recent Canada-U.S. trade tensions and whether or how much that suppresses enthusiasm for trading with the U.S. among both francophones and anglophones, as well as whether that impact translates into greater receptiveness to trading with partners in the Indo-Pacific.

As of mid-2024, support among both francophones and anglophones for trading with several of these economies, namely, in Southeast Asia, was low, ranging from 22 to 29 per cent (for Malaysia and Singapore, respectively) among francophones and from 30 to 35 per cent (Indonesia and Singapore, respectively) among anglophones (see Graph 2). These low levels of support should be a concern for both the Quebec government and Canadian federal government; Ottawa is negotiating a free trade agreement with the Association of Southeast Asian Nations (ASEAN) and is hoping to conclude those talks in 2025. It also recently (December 2024) concluded a bilateral trade arrangement with Indonesia. Yet it seems that at the time this survey was conducted, there was insufficient recognition among both francophone and anglophone Canadians of the benefits of these trade-based partnerships.

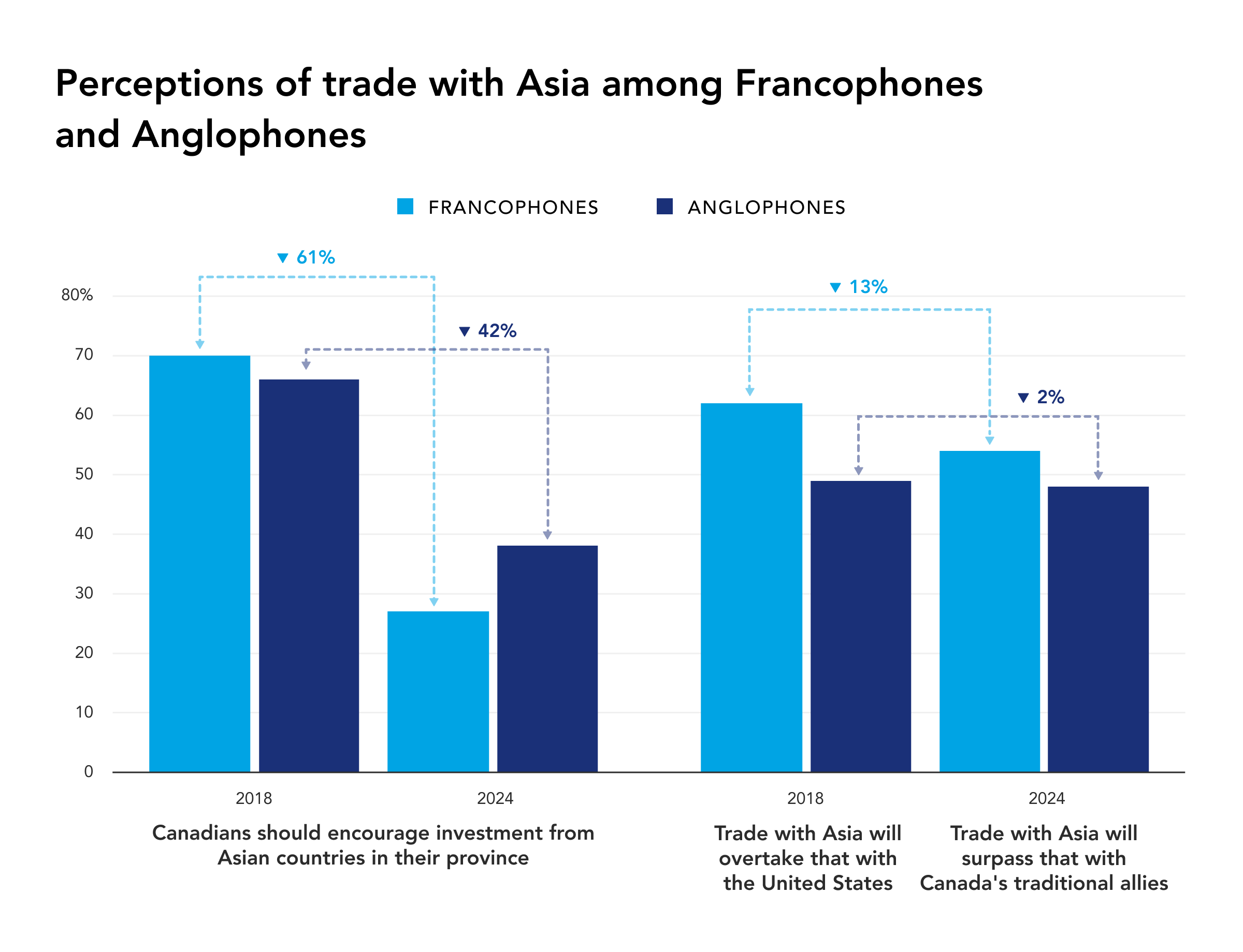

Another possible area of attention for the federal and Quebec governments is the decline in support for Asian investment in Canada. In 2018, this support was high among both francophones and anglophones: 70 per cent vs. 66 per cent, respectively. However, by 2024, this sentiment had plummeted to 27 per cent among francophones and to 38 per cent among anglophones.

This sharp drop in support for Asian investment could be driven by the impetus among several Western economies, including Canada, to decouple (or de-risk) their economies from China. It could also be due to factors unrelated to economics and related more to other types of issues, such as Beijing’s arbitrary detention of two Canadians in 2018 and more recent accusations by Canada of foreign interference by the Chinese government. In Quebec, one high-profile example of this inclination to disengage from China was the announcements by two major provincial investment organizations, Caisse de dépôt et placement du Québec (in 2023) and Investissement Québec (in 2024), that they were closing their offices in China due to geopolitical tensions and deteriorating relations.

Similarly, high percentages of both francophones (70.5%) and anglophones (72.5%) see China’s rise as a threat to Canada’s interests. There are differences, however, in how much this wariness toward China has grown. In 2018, francophones’ favourability towards China and the U.S. were at roughly similar levels. In 2024, only eight per cent of francophones surveyed said they trusted China (compared to 10 per cent of anglophones). It should be noted that despite these growing feelings of negativity and disengagement, China remains Quebec’s and Canada’s second-largest trading partner.

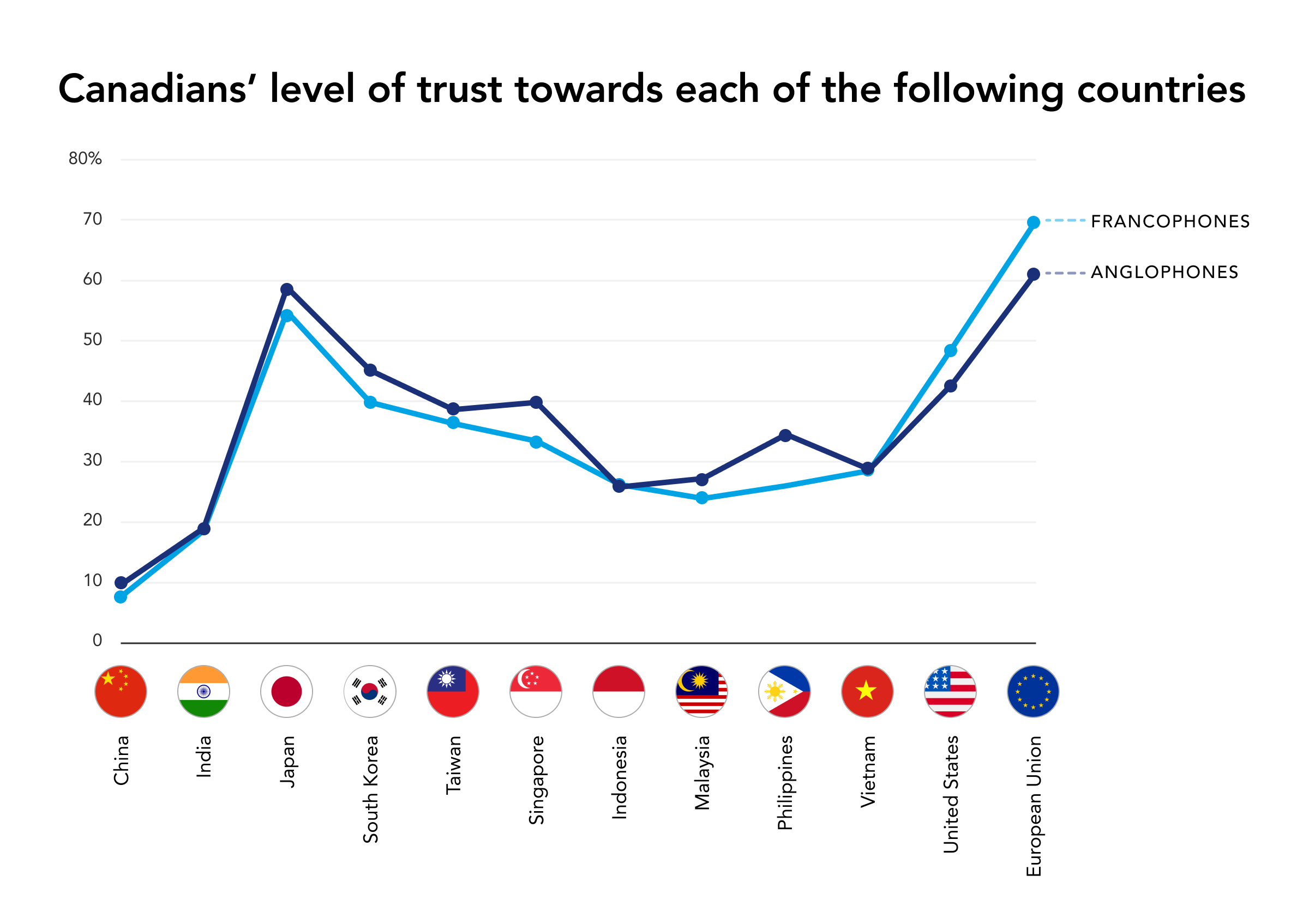

In 2024, this slightly lower level of trust by Quebec’s francophones extended to almost all of the Indo-Pacific countries included in the survey, except Indonesia (see Graph 3). Remarkably, these figures illustrate a reversal from APF Canada’s 2018 National Opinion Poll, which showed that, at the time, francophones had warmer feelings than anglophones toward all Indo-Pacific countries except for India.

One interesting outlier is Japan, which both francophones and anglophones trusted more than the U.S., even before the latter’s November 2024 election. Despite Canadians’ increasing reluctance to welcome Asian investment in their province, the trust in Japan is promising, as Japan remains Canada’s largest source of FDI from the Indo-Pacific region and third overall. Japanese companies have also played a significant role in Quebec’s aerospace, IT, and cleantech sectors, fostering innovation and technological progress in the province.

Immigration: A divisive issue

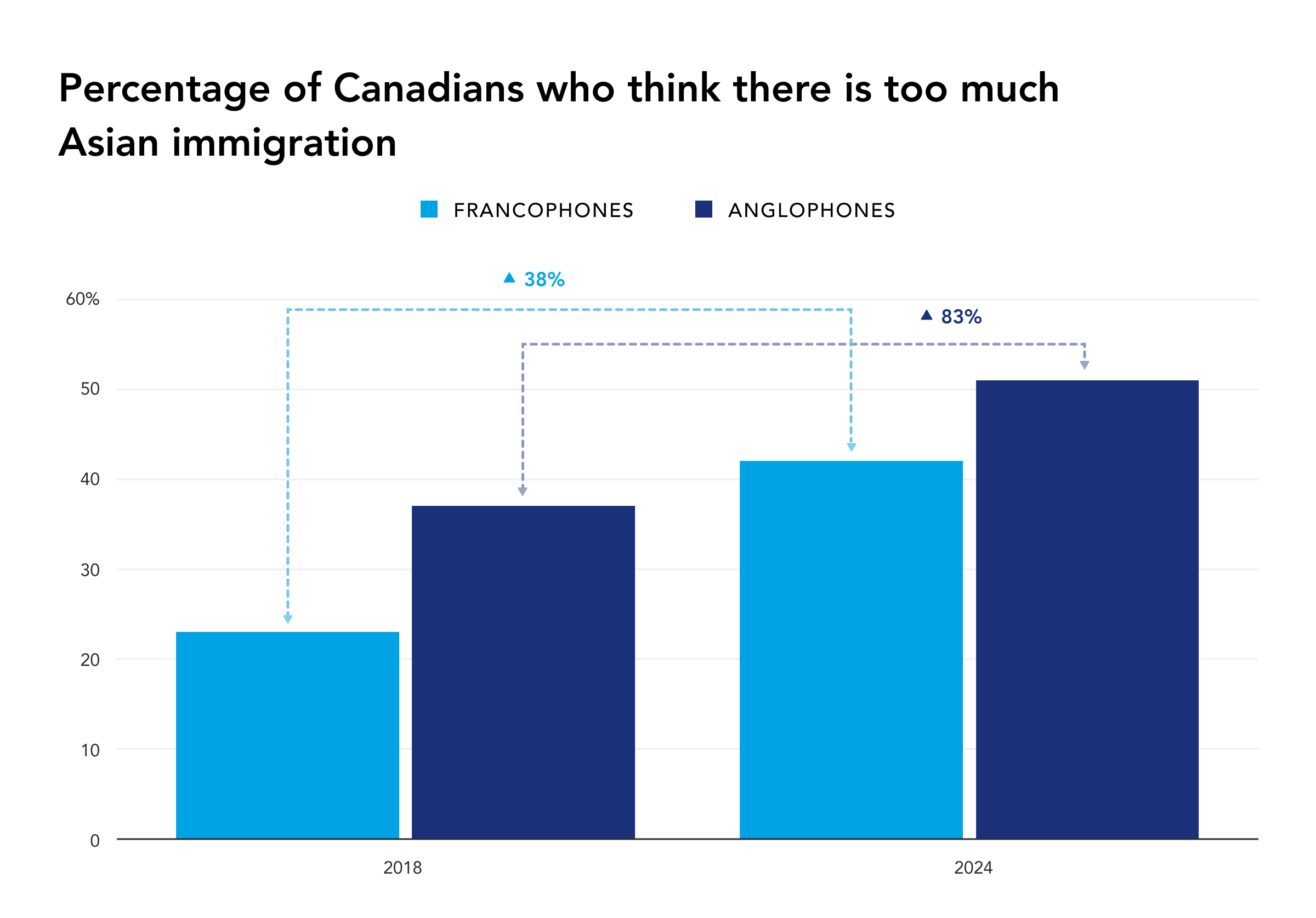

Immigration from Asia is another issue on which there is sometimes a lack of consensus in Canada, including between Quebec and other provinces. When asked in 2024 whether there was too much Asian immigration to Canada, 42 per cent of francophone respondents said yes, compared to 51 per cent among anglophones. This nine-point gap may come as a surprise, as many have the impression that Quebecers are less receptive to immigration than other parts of Canada. However, these results should be interpreted with some nuance. For example, Ontario and British Columbia have the largest Asian populations in the country: In fact, these two provinces alone account for over 70 per cent of Canada’s Asian diaspora. The higher presence of this diaspora may feed the perception among some in those provinces that there is too much Asian immigration to Canada. Meanwhile, Quebec, Canada’s second-most populous province, accounts for less than seven per cent of the country’s Asian diaspora.

These latest survey findings mark a significant increase in the perception that there is too much Asian immigration among both anglophone Canadians and Quebec-based francophones. In APF Canada’s 2018 National Opinion Poll, 23 per cent of francophones and 37 per cent of anglophones felt there was too much immigration from Asia. By 2024, this perception had increased in both groups, albeit by varying margins: 83 per cent among francophones and 38 per cent among anglophones (see Graph 4).

For Canadians who welcome Asian immigration to Canada, these changes are a worrying trend and are broadly consistent with a more general negativity towards immigration. Recent Focus Canada research reveals that nearly six in ten (58%) Canadians now feel the country admits too many immigrants.

In Conclusion

While the federal government has invested C$2.3 billion in its Indo-Pacific Strategy, there are still gaps in Canadians’ perceptions of the positive impact of engaging more broadly with that region. The media may be part of the explanation for these views. In fact, the need for more media coverage was one area on which francophones and anglophones share similar views: only 31 per cent of the former and 32 per cent of the latter felt that Canadian media was sufficient in its coverage of Asia, a share lower than in APF Canada’s 2020 NOP. Greater media coverage of Asia would enable Canadians to deepen their knowledge of the region and better appreciate the benefits of being an engaged partner with Asian countries. It would also bridge the gap between government initiatives in Asia and the tangible impacts perceived by Canadians.

With the U.S. recently threatening to impose significant tariffs on Canada, the latter should double down on its efforts to reduce its dependence on U.S. imports by diversifying its global trade. Asia Pacific economies offer great potential, especially as this region is expected to account for 50 per cent of global GDP by 2040. It will be interesting to observe how U.S.-Canada trade disruptions will or will not impact Canadians’ feelings about trade with Asia.

• Additional editing by Vina Nadjibulla, Vice-President Research & Strategy, APF Canada