As the global race for critical minerals intensifies, India stands at a crucial crossroads in securing its energy and industrial future. The Indian Economic Survey, released by the Ministry of Finance on January 31, 2025, raised the alarm over the risks of India’s heavy dependence on Chinese resources, including the critical minerals needed for its green energy transition. Amid growing trade disruptions and geopolitical uncertainties, the survey stressed the urgent need for India to diversify supply chains and invest in securing alternative sources of these vital minerals. Building on this momentum, Indian Finance Minister Nirmala Sitharaman’s Union Budget, announced the following day, introduced import duty exemptions for 16 additional critical minerals, expanding on the 25 exemptions on critical minerals from 2024, including for nickel, cobalt, and lithium, thus paving the way for increased imports of these minerals from other sources.

Canada, one of the world’s leading resource powers, boasts abundant mineral reserves. In 2023, the country produced more than 60 minerals and metals worth C$72 billion. While the U.S. remains Canada’s largest trading partner, importing nearly 60 per cent of Canada’s critical mineral exports, the recent U.S. tariff measures — including those on critical minerals — have prompted Canada to seek new trade opportunities. This presents an opportunity for Canada to strengthen economic ties over critical minerals with India, which is actively working to reduce its dependence on a single country for the supply of these minerals.

India's Rising Mineral Needs

India’s objective of becoming a developed economy by 2047 hinges on revitalizing its underperforming manufacturing sector, which made up 13 per cent of its GDP in 2023, down from 17 per cent in 2010. As part of this goal, India is prioritizing domestic manufacturing in key sectors, including semiconductors and electric vehicles (EVs). With five semiconductor units approved and more projects in the pipeline, these chips are critical for renewable energy systems, EV powertrains, and energy-efficient technologies, all of which will need a steady supply of critical minerals. Meanwhile, the EV market is projected to grow at a compound annual growth rate of 28.5 per cent—from C$7.3 billion in 2024 to C$25.7 billion by 2029, further driving the demand for critical minerals.

Based on assessments of reserves, import dependency, and future needs, India has identified 30 critical minerals, 10 of which — including nickel, cobalt, and lithium — are 100 per cent import-dependent and essential for EV batteries, electronics, and cleantech. India’s demand for these minerals is set to rise dramatically, as EVs require six times more minerals than conventional vehicles. Many of these minerals are either scarce or not processed domestically, making imports essential for domestic manufacturing, alongside strategic investments in domestic mining and extraction capabilities with international partnerships playing a crucial role in scaling these efforts.

Canada’s Untapped Potential in India’s Mineral Shift

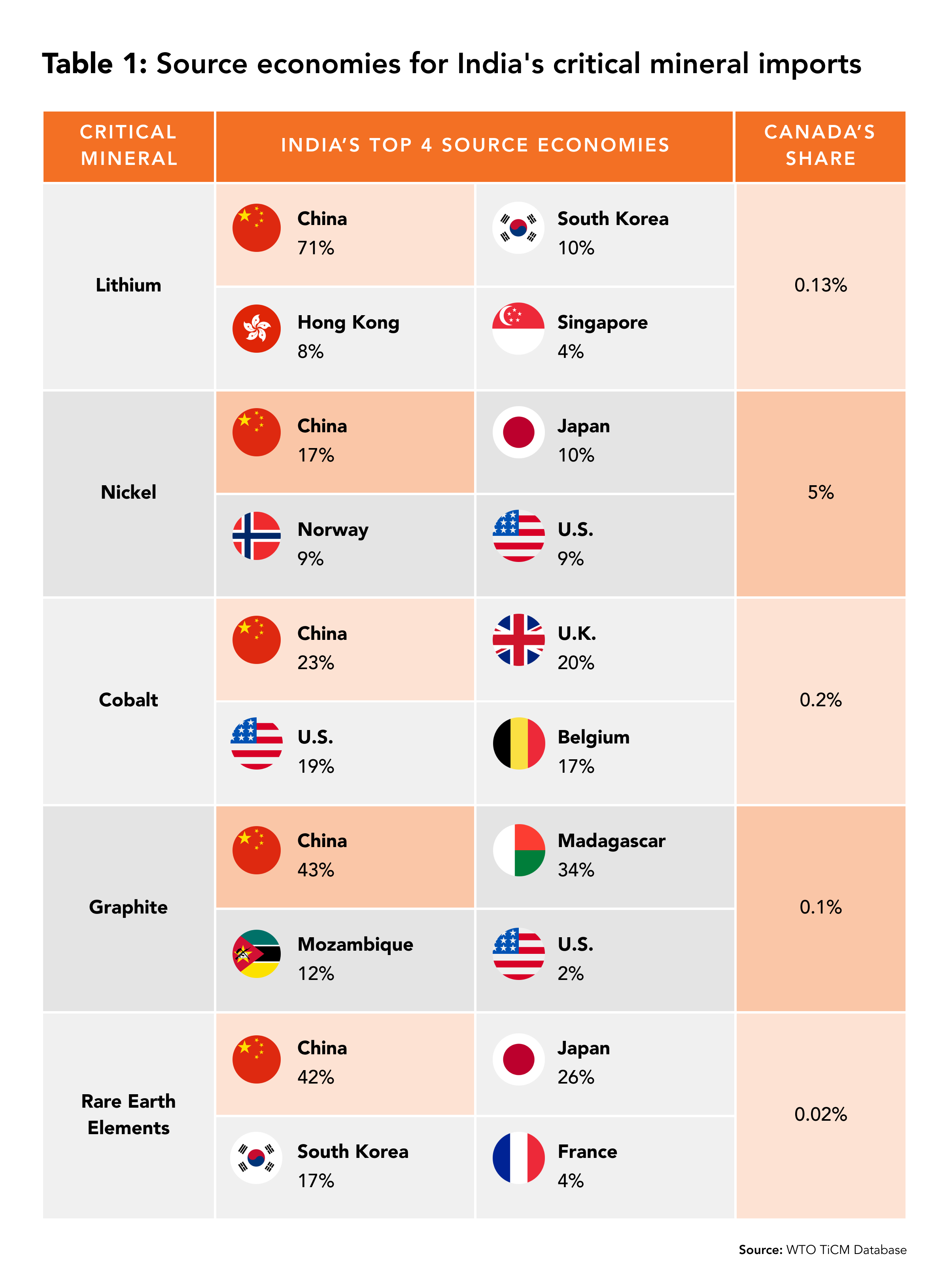

Canada is uniquely positioned to meet India’s growing demand for critical minerals, thanks to its vast mineral reserves and strong practices in sustainable mining. However, Canada’s contribution to India’s critical mineral imports remains minimal, with only two per cent of its total critical mineral exports — valued at C$1.04 billion in 2023 — going to India. Meanwhile, China dominates as India’s largest supplier of essential minerals such as lithium, nickel, cobalt, graphite, and rare earth elements, which are critical for EVs and clean energy technologies. In comparison, Canada remains a minor supplier of these minerals to India (Table 1).

This heavy reliance on China poses serious security concerns for India. Critical minerals are essential not only for clean energy technologies but also for military and defence applications. China’s track record of leveraging mineral exports as a geopolitical weapon — such as its 2010 rare earth export ban to Japan and recent restrictions on key minerals to the U.S. — highlights the vulnerabilities of over-dependence. With about 70 per cent of India’s lithium imports and 75 per cent of its lithium battery needs reliant on China, any disruption in supply could critically undermine India’s manufacturing goals, stall its technological advancements, and weaken its defence preparedness. cent of its lithium battery needs reliant on China, any disruption in supply could critically undermine India’s manufacturing goals, stall its technological advancements, and weaken its defense preparedness.

Canada, too, faces challenges in its critical mineral trade, as its exports are heavily concentrated on a few markets. In 2023, 59 per cent of Canada’s critical mineral exports were sent to the U.S., followed by seven per cent to China and five per cent to Brazil. This overreliance on a limited set of trading partners heightens Canada’s exposure to geopolitical and trade risks.

To address these challenges, Canada launched its Critical Minerals Strategy (CMS) in 2022, with the goal of strengthening domestic production capacity, attracting investment, and establishing secure global supply chains. Twenty-two of the 34 minerals identified by Ottawa as "critical" — and prioritized for economic development and federal investment — are also on India’s critical mineral list. These include lithium, graphite, nickel, cobalt, copper, and rare earth elements. Most recently, on February 6, the Canadian government announced C$43.5 million in funding under CMS through the Critical Minerals Infrastructure Fund for six energy and transportation projects to support critical minerals development, and through the Critical Minerals Research, Development, and Demonstration program to pilot lithium extraction research in Quebec.

While the CMS underscores the development of Canada’s critical minerals sector, along with supply chain diversification and geopolitical risk mitigation — explicitly referencing its alignment with Canada’s 2022 Indo-Pacific Strategy — it lacks specific initiatives to engage with India. While Canada has formalized critical mineral agreements with the U.S., European Union, and Japan, and is collaborating with allies such as the U.K. and South Korea, India remains notably absent from Canada’s strategic focus. This gap presents a significant missed opportunity for growth and trade expansion with one of the world’s fastest-growing economies.

The potential for Canada-India collaboration in critical minerals is immense. Beyond its existing trade in minerals and metals, Canada, according to the International Trade Centre, holds at least C$589 million in unrealized export potential in critical minerals essential for India's clean energy goals. This includes potassium chloride (potash) used as fertilizer (C$344M), waste and scrap of aluminum (C$127M), copper ores and concentrates (C$31M), unwrought nickel (C$76M), intermediate products of cobalt metallurgy (C$11.7M), and lithium cells and batteries (C$0.15M). With new and existing mining projects underway, this potential could expand significantly through strengthened trade partnerships with India.

Current Agreements and Economic Partnerships

- Past Efforts: Between 2010 and 2014, Canada and India signed several memoranda of understanding, focused primarily on mining and mineral exploration. Notable partnerships included collaborations between Natural Resources Canada and India’s Ministry of Mines, as well as joint initiatives between Saskatchewan and Gujarat’s Minerals Development Corporation.

- Current Bilateral Stalemate: At present, negotiations for a Comprehensive Economic Partnership Agreement or even for an Early Progress Trade Agreement between Canada and India have been paused. Adding to the challenge, India is not part of any major regional trade agreements or economic groupings including Canada, such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership. While India joined the U.S.-led Mineral Security Partnership in June 2023, of which Canada is also a member, no joint projects between the two countries under this framework have been announced.

- Strategic Initiatives and Future Prospects: In 2019, India established Khanij Bidesh India Limited to explore, acquire, develop, mine, process, and procure critical minerals from overseas for use within India. KABIL is currently in discussions with countries such as Argentina, Australia, and Chile for key minerals, but Canada has not yet been prioritized for such partnerships, possibly hinting at a lack of political will driving such initiatives. However, with the recent C$5.7-billion National Critical Mineral Mission package, India aims to strengthen trade with resource-rich nations and boost domestic production. This presents Canada with an opportunity to leverage this initiative and play a more active role in India’s mineral security.

Canada’s Strategic Edge in India’s Mineral Transition

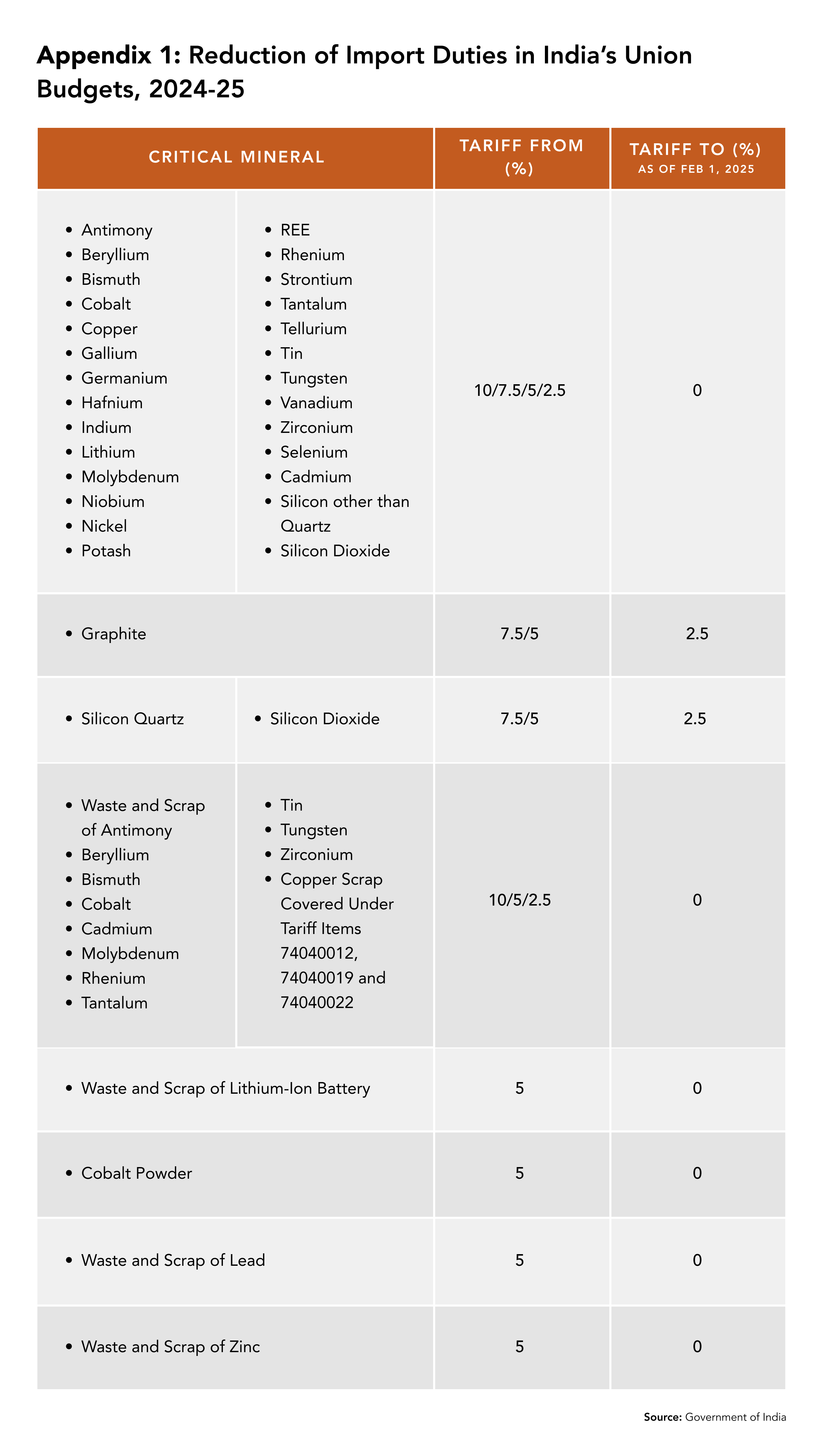

As India seeks to reduce critical mineral reliance on a single source, it is actively diversifying its global partnerships. In 2022, it signed the Economic Cooperation and Trade Agreement with Australia and the Australia-India Critical Minerals Investment Partnership, both aiming at securing a stable supply of critical minerals. While these agreements give Australia a significant advantage over other countries — granting duty-free access to over 85 per cent of Australian goods exports (by value) to India — recent Indian budget announcements have further extended duty-free provisions to 41 critical minerals such as cobalt, copper, niobium, potash, and lithium for all countries (Appendix 1). This change provides Canada with an opportunity to position itself as a partner in meeting India’s mineral demands, as the removal of tariffs now allows it to compete on equal footing despite the absence of a formal trade agreement.

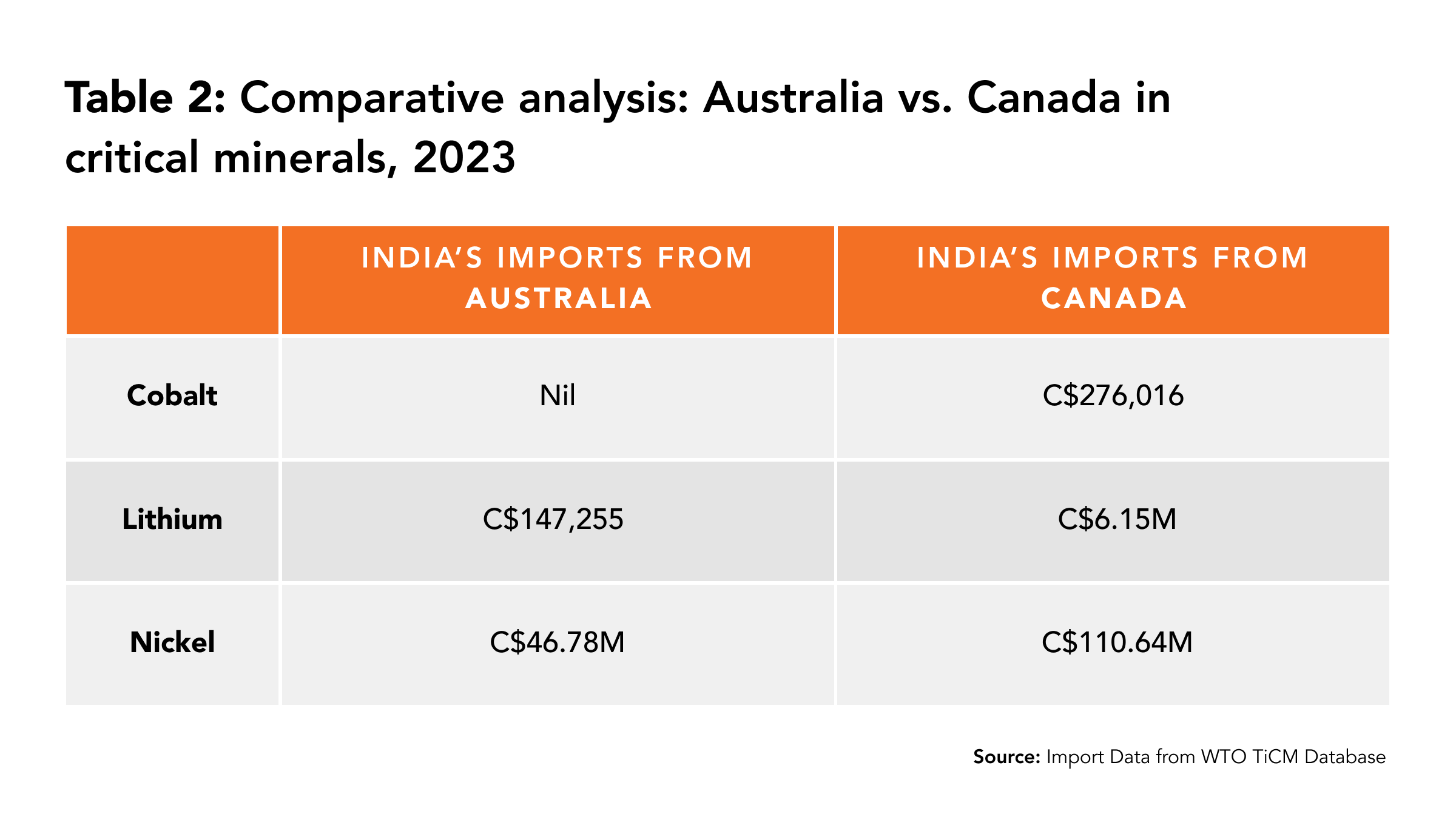

While Australia boasts the second-largest reserves of lithium (after Chile), cobalt (after Congo), and nickel (after Indonesia), Canada currently already supplies a larger share of these critical mineral exports to India, showcasing the potential for bolstering the partnership. Notably, Australia did not export any cobalt to India in 2023, while, the same year, Canada supplied C$276,016 worth of cobalt to the country (refer to Table 2).

Furthermore, Canada is the world’s largest producer of potash, a critical mineral used in fertilizers for agricultural production. In 2023, Canada exported approximately C$650 million worth of potash to India, accounting for 63 per cent of Canada’s total critical mineral exports to the country. Saskatchewan, Canada’s largest potash-producing province, has maintained strong trade ties with India, further strengthened by strong advocacy that led to the reinstatement of an Indian visa for a Saskatchewan trade official following a diplomatic standoff. With Saskatchewan responsible for over 25 per cent of Canada’s total trade with India and potash a key export, Canada is well-positioned to expand supply and support India’s fully import-dependent potash needs.

Additionally, Canada can be a valuable partner in addressing another area where India faces challenges, such as lithium mining expertise, particularly in exploration and clay-based lithium extraction. This was evident in the failed auction of the Indian state Jammu and Kashmir's 5.9 million-tonne lithium reserve, which struggled to attract sufficient bidders due to inadequate exploration data, concerns over commercial viability, and the complexities of extracting lithium from clay deposits. While New Delhi is pursuing a three-year India-Australia Critical Minerals Investment Partnership worth 5.23 million, alongside other joint projects, Canada also has a lot to offer.

Ranked first in mining potential by global companies in the critical minerals sector, Canada can provide advanced mining expertise, cutting-edge exploration technologies, and sustainability-focused practices. For instance, Canadian technologies such as muon tomography — which enables precise subsurface imaging and minimizes the need for extensive and environmentally disruptive drilling — could assist India in unlocking its lithium reserves more efficiently and with reduced ecological impact. Additionally, Canadian companies such as Cypress Development Corp are pioneering the use of hydrochloric acid leaching for lithium extraction from clay deposits, a process that could be instrumental in helping India develop its lithium reserves, particularly in regions like Jammu and Kashmir, where extraction challenges persist.

Embracing a Mutual Need for Diversification

The ongoing threat of U.S. tariffs on Canada serves as a stark reminder of the risks associated with over-reliance on one trade partner. For Canada — a country in which trade is responsible for two thirds of GDP and supports one-in-six jobs — this underscores the urgent need to diversify export markets and bolster economic resilience. Expanding critical mineral trade with India presents a strategic growth opportunity yet to be fully explored, as India currently accounts for just two per cent of Canada’s total critical mineral exports, leaving substantial room for expansion.

Despite political roadblocks, trade between the two nations continues to grow, with total goods trade increasing by five per cent and Canada’s goods exports rising by 3.3 per cent from 2023 to 2024. To build on this momentum, provinces with significant mineral trade — such as Ontario, Quebec, British Columbia, and Saskatchewan — can take the lead in further strengthening existing partnerships and forging new ones with Indian buyers and businesses. Industry-led collaboration, bolstered by India’s policy permitting 100 per cent foreign direct investment in critical mineral mining and the introduction of exploration licenses to attract private and foreign companies, offers a path to deeper engagement.

While business-led partnerships continue to grow, unlocking their full potential will require stronger political commitment. Indian Prime Minister Narendra Modi’s recent visit to the U.S. on February 12–13, 2025, resulted in multiple new collaborations, including the launch of the Strategic Mineral Recovery Initiative to enhance critical mineral processing, as well as joint efforts to boost R&D and investment across the entire value chain — largely driven by political will and shared strategic interests. Alongside India’s existing partnerships with countries such as Argentina, Australia, and Chile, these recent initiatives underscore its commitment to securing stable critical mineral supply chains.

India has signalled openness to working with Canada, with Indian Foreign Minister S. Jaishankar stating in December 2024 that as India’s economy expands, it will prioritize partnerships with resource-rich nations, including Canada, to sustain its growth. He emphasized "changing metrics" and the need for a "new rationalization" of partnerships, indicating that India is reassessing its foreign relations based on evolving economic and strategic priorities. For Canada, aligning with this strategic shift and deepening critical mineral co-operation could provide a pragmatic pathway for stronger economic ties and enhanced supply chain resilience, ultimately benefiting both nations.

• Edited by Charles Labrecque, Research Director, Vina Nadjibulla, Vice-President Research & Strategy, and Ted Fraser, Senior Editor, APF Canada