The results of China's 2021 census, which showed a continued slowing in population growth, triggered much discussion of the implications for China's economic growth potential, its society, and its standing in the global economy.

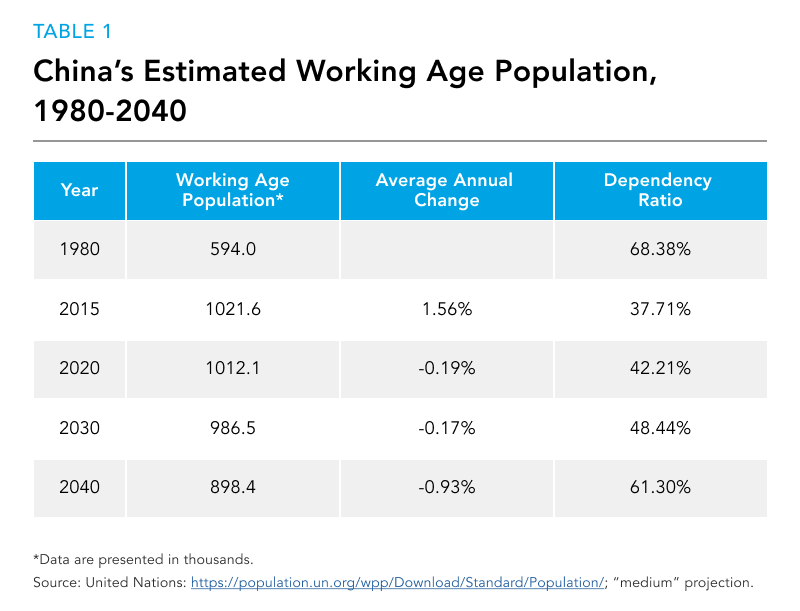

As background, between 1980 and 2015, China's working-age population grew from 594 million to 1,021.6 million, or by 72 per cent. On average, the labour force population grew by 1.56 per cent per annum, providing a strong demographic boost to aggregate growth. However, since 2015, the working-age population has been on the decline. As shown in Table 1, by 2020, it fell to 1,012.8 million, or by -0.19 per cent per annum, and is projected to continue to fall at about the same pace over the period to 2030, and then much more rapidly over the period to 2040.

As China's working-age population expanded, its dependency ratio – the sum of the young population (under age 15) and elderly population (age 65 and over) relative to the working-age population (ages 15 to 64) – fell steeply, from 68.38 per cent in 1980 to a trough of 36.49 per cent in 2010. It started to rise thereafter, reaching 37.71 per cent in 2015 and an estimated 42.21 per cent in 2020. It is projected to continue to rise to 61.3 per cent by 2040.

Numerous commentaries have raised the spectre of a 'demographic time bomb' for China's economy and society as China ages, including pressure on the hospital system and underfunded pension plans (Wee, 2021) and on its social fabric (Eberstadt, 2017). Others focus on the implications of the loss of the 'demographic dividend' for economic growth and project substantially lower long-term growth rates than China has been accustomed to (Eberstadt, 2017; Li et al., 2017). A fall in the real growth rate below the real interest rate creates risk for the sustainability of a country's debt (on this relationship, see e.g. Mehrotra and Sergeyev, 2021); this would be a worry for China given its high public debt load.

Other consequential issues include whether this means China will be caught in the middle-income trap and "grow old before it grows rich" (Chen and Yip, 2021); and, whether China will eventually surpass the United States as the world's largest economy when compared at market prices (China is already the world's largest economy at purchasing power parity) – and what this means for geopolitical and geoeconomic rivalry.

Not all commentators see the situation as dire. For example, Turner (2021) argues that a declining population may be a good thing from a sustainability perspective and not necessarily harmful to the economy. Meanwhile, Rachman (2021) sees China's technological capabilities in areas such as robotics and artificial intelligence as assuring China's continued rise.

In this report, I review some of the many margins of adjustment that will be active in the coming decades and discuss the implications of the coming transition to an economy driven by machine knowledge capital. I conclude that demography is not destiny and, indeed, that China picked a good time to grow old.

Margins of Adjustment

There are various ways in which China's economy will adjust to the demographic impulse of slowing growth in the working-age population, a reality that is largely inescapable for the coming two decades as this has been pre-determined by the birth rate over the past two decades.

Participation rate

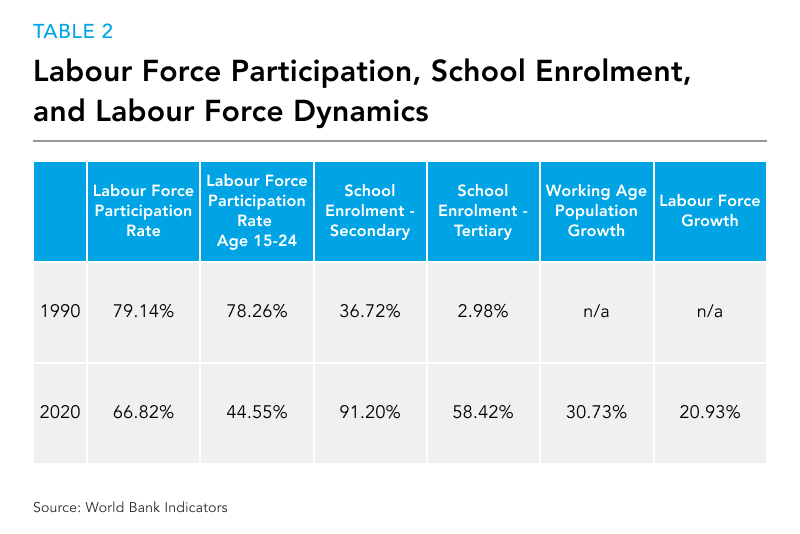

China's labour force participation rate fell steeply over the past three decades, from 79.14 per cent in 1990 to 66.82 per cent in 2020. This appears to have been mainly due to rising school enrolment rates as secondary and tertiary education expanded massively. By the same token, the labour force participation rate of young people aged 15-24 fell from 78.26 per cent in 1990 to 45.55 per cent in 2019. This means that China's labour force growth was much slower than the growth in the working-age population. Accordingly, for China's economy, the adjustment to a shrinking labour force will not be quite as severe as might be inferred from the scale of decline in the working-age population.

China's tertiary school enrolment has considerable headroom to increase from the 58.42 per cent registered in 2020, and it likely will – for example, the comparable figure for the United States in 2020 was 87.9 per cent. However, increasing demand for workers implies rising real wages, and some analysts have determined that China has long passed the so-called "Lewis Turning Point," where worker wages begin to rise faster than the rate of inflation because the excess labour reserve in rural areas has been mostly drawn down (for discussions, see Cai, 2010; and Liu 2015). Improving immediate job prospects for young people implies a flattening out of the pace of increase in school enrolment and a parallel flattening of the decline in labour force participation in that age group.

Retirement age

A second margin of adjustment for labour force participation is retirement age. China's official retirement age is 60 for male workers, 55 for female civil servants, and 50 for female blue-collar workers – the average of about 54 is well below the OECD average of 64.2 (The Economist, 2021). These compulsory retirement ages have been in force since the 1950s (Feng et al., 2019), despite the steep increase in life expectancy in China. Cognizant of these demographic dynamics, China is planning to gradually raise the retirement age (Hua, 2021).

Perhaps more importantly, rising real wages will create incentives for healthy older workers to remain in the labour force. Canada, which has had below-replacement fertility for decades, has experienced an increase in labour force participation in the 55+ age group due to delayed retirement (Carrière and Galarneau, 2011), in the context of rising real wages for older workers (Fields et al., 2017). Additional benefits of staying in the workforce for healthy older workers are mental stimulation and social engagement. Accordingly, China has simply to provide flexibility in retirement choices to allow market incentives to raise participation closer to the OECD average. As a bonus, relaxing the retirement laws to allow market selection for who stays in the workforce longer would likely select for higher productivity workers, in particular knowledge workers, providing a structural boost to productivity.

Immigration

China can encourage immigration to manage its labour force needs, particularly in highly skilled areas, as it has been doing through its Thousand Talents program designed to reverse the brain drain. In 2018, China allowed overseas Chinese to qualify for five-year, multiple-entry visas or residence permits (Pieke et al., 2019). Moreover, China is increasingly an education exporter, hosting on the order of 500,000 foreign students in 2018, with policies such as the Study in China Program launched in 2010 and the Silk Road Scholarship Program launched in 2016 (Qi, 2021). It is a short step from studying in China to remaining in China to work.

Fertility rate

Raising the fertility rate is now an objective of the Chinese government. Having rescinded the one-child policy following the 2011 census, it has now replaced it with a three-child policy, along with supporting measures for encouraging having children and no penalties for having more than three (Zhang, 2021). Any material boost to China's labour force growth from higher fertility would be in the post-2040 period. Meanwhile, in the short run, increased fertility actually implies lower female labour participation during the child-bearing years.

To minimize the negative impact of higher fertility rates on women's labour force participation rates, the supporting measures for the three-child policy take aim at several obstacles to Chinese families having children – including high property prices, inaccessible childcare, the burdens of elder care, and other obstacles to combining work and family life such as onerous work hours (Adair, 2021; Tatum, 2021). Policy initiatives under consideration reportedly include making childcare services tax-deductible, increasing availability of community daycare, improving maternity leave provisions and maternity insurance, introducing re-employment training services for women whose careers are interrupted by childbirth, and so forth (Zhang, 2021). Clearly, China wants its children and women workers too.

Market forces must also be reckoned with. Rising real wages for women, which can be anticipated from the combination of tighter labour supply and measures against workplace discrimination against women, would work to reduce observed fertility rates. This effect might be quite limited if the U.S. experience is any guide. There, rising women's wage rates were associated with falling fertility initially, but fertility rates then stabilized as households reallocated tasks in home production and childcare from women to men, and market-based solutions were adopted to reduce the time costs of household production (see Siegel, 2017). China's trajectory might well follow this pattern; Zhang (2021), for example, comments on the likelihood of market opportunities opening up in China in areas such as pregnancy and daycare services, eldercare, and health care, among others. At the same time, higher female wages also increase household income. In conventional demographic theory, the demand for children rises with household income but falls with their opportunity cost (in that sense, children are a 'normal good') (Ciuriak and Sims, 1980; and, Siegel, 2017).

Given the complex interplay of the mix of policies aimed at contradictory policy objectives and the equally complex interplay of market forces working on the trade-offs between higher fertility and higher women's labour force participation, the net effects can hardly be predicted. However, insofar as China's women have on balance time freed up to both have more children and to engage in market work, some stabilization of the declines in both indicators could be expected.

Cohort effect on human capital

In a study shared in their paper "Human Capital and China's Future Growth," Li et al. (2017) drew on the empirical relationship between rising educational attainment and rising per capita income to show that China's historical growth in per capita income involved two margins of improvement. First, starting from a per capita income well below that predicted by its educational attainment, China largely (but not entirely) closed the gap by 2014; this accounted for 40 per cent of China's per capita income growth between 1980 and 2014. Second, the steep increase in China's average educational attainment accounted for a further 65 per cent of China's per capita income growth over the period.[1] This study further notes that three reservoirs of per capita income growth (rise in the working age share of the population; movement of rural workers to urban areas; and, the shift of the labour force into private enterprises together with the shift of most state-owned enterprises onto a more efficient labour utilization similar to private firms) have largely been exhausted. On this basis, the study concludes that China's per capita income growth was destined to sharply slow down, even with optimistic assumptions about continued improvements in educational attainment.

However, an optimistic assumption is not unwarranted. It reflects, first, the cohort effect on average educational attainment. Over the period to 2030, the age cohorts exiting the labour force have average educational attainment that China recorded in the 1980s. In the early 1980s, the average years of schooling for China's labour force aged population was 7.6 years and had increased to only 8.4 years by 2000. The cohort entering the workforce in the early 2020s has an average number of years of schooling of approximately 13 to 14 years. This increase reflects the fact that 100 per cent of Chinese youth in the ages through junior high school are enrolled; 91.2 per cent of the cohort of senior high school are enrolled; and 54.5 per cent of those in the higher education age group are enrolled (China Planning Department, 2021). Even with slowing increases in enrolment, which over the coming decade will be confined mainly to the age groups eligible for higher education, this structural cohort effect will drive China's average educational attainment steadily forward over the next two decades to 2040.

A second reason for optimism concerns the transformation of China's economy over the course of the 2000-teens into a knowledge-based and data-driven economy. The United States entered the knowledge-based economy (KBE) era around 1980; it made the shift into the data-driven economy (DDE) around 2010, driving off technological innovations in the late 2000s that underpinned the rapid development of new general-purpose technologies built on big data, machine learning, and artificial intelligence (Ciuriak, 2021). China entered both the KBE and the DDE around 2010. Around 2014, when the Li et al. (2017) analysis ends, China's patenting activity and data-driven activities such as e-commerce were surging (Ciuriak and Ptashkina, 2021a), testifying to the success that China has had in making this transition. Notably, knowledge-based and data-driven economies feature strong knowledge spillovers in the workplace, which implies continued human capital development on the job.[2] Between 2014 and 2020, China's per capita GDP rose from 13.9 per cent of the U.S. level to 16.6 per cent. Another indicator of a powerful dynamic in China's innovation-intensive, knowledge-based and data-driven economy is the number of high-growth technology firms: By late 2021, China had 170 Unicorns (a startup company valued at over US$1 billion), second only to the United States, which had 470.

Accordingly, there is every reason to believe that China will not only continue to converge to the international norm in terms of the ratio of per capita income to educational attainment but could well move above the international average as a leading knowledge-based and data-driven economy, particularly at its current per capita income level.

Capital deepening: Robots and machine knowledge capital

China chose a particularly propitious time to grow old: This is the age of artificial intelligence (AI) and robotics – and China is at the technology frontier in both areas (Rachman, 2021).

Regarding robots, as Cheng et al. (2019) document, China's share of annual global robot sales rose from 3.7 per cent in 2005 to 12.4 per cent in 2010 and 30 per cent in 2016. In 2016, China led the world in terms of the largest operational stock, with a total of 339,970 operational units or 19 per cent of the world total.

China is also a leading producer and innovator in the robotics sector, exhibiting a similar vertiginous increase in activity. China's production rose from 5,800 robots in 2012 to 131,000 in 2017, of which 29 per cent was accounted for by Chinese firms, the remainder by foreign-owned firms (Cheng et al., 2019). There are similar steep increases in the number of firms operating in the robotics sector and in patenting activity mentioning robots.

Importantly for an economy the size of China's, this is a scalable activity, which means China has considerable headroom for intensified use of industrial robots to replace workers, as human workers become the scarce factor of production.

Equally, if not even more importantly, the present decade will see a massive expansion of machine knowledge capital as commercial applications of artificial intelligence are rolled out. Machine knowledge capital both complements and replaces human capital, but unlike human capital, it is eminently scalable. For the labour-intensive services sector, machine knowledge capital promises to lift the Baumol effect, the stylized fact that the transition into a services-intensive economy is accompanied by slowing productivity growth. This slowing in productivity due to rising services shares of GDP reflects the fact that human capital is not scalable; but, machine knowledge capital is not subject to this constraint (Ciuriak, 2021).

Machine knowledge capital in the form of embedded AI also enhances the flexibility of robots, which will facilitate labour-saving capital deepening in industrial settings. For example, the integration of AI, improved sensors, sophisticated software, and 5G telecommunications technology allows warehouses to operate autonomously on a literally 'lights out' basis (Bowles, 2020). Ciuriak and Rodionova (2021) describe other industrial settings where such labour-saving technology has already been pioneered.

Discussion and Conclusions

China's scope for adjustment to the declining working-age population is both broad and deep. The above discussion suggests that the role of the 'demographic dividend' in China's growth in the 1980-2020 period was less than might be inferred from looking at working-age population dynamics given the steep rise in school enrolment rates over that period. Moreover, a continued increase in China's human capital stock seems assured for the medium term as the age cohorts entering the labour force over the coming two decades will have much higher educational attainment than the age cohorts exiting – and entrants will be joining an economy that has been transformed by China's transition into a knowledge-based and data-driven economy which features knowledge spillovers. Taking into account natural incentives (income, mental stimulation, and social engagement) to continue working at older ages, policy adjustments to mandatory retirement age can also substantially contribute to easing labour supply constraints (Kruger, 2021).

More importantly, when the 2020s are analyzed in retrospect, it is likely to be seen as the decade of machine knowledge capital, an eminently scalable substitute and/or complement for human capital: Between robotics and AI applications, the technological basis is there for China to continue its rise, notwithstanding the loss of the 'demographic dividend' of a rising working-age population. Notably, there is no social resistance to such technological adoption in China (Cheng et al., 2019) and, in fact, strong public policy support for it. From this perspective, the pressures on China's economy from the demographic transition will drive China's continued rise rather than serving to slow it to a crawl.

By the same token, China's per capita income should continue to converge to the levels found in advanced economies. Indeed, there are many reasons to support the conclusion that China will not hit a middle-income trap. The most compelling reason is that, insofar as there is such a trap, it is a product of an absence of firms and limited technology, and China has an abundance of both.

On the first point, most of China's workforce is now in the private sector – 143 Global 500 firms are domiciled in China, and its total number of Unicorns is second only to the United States. China has firms – and is continuously adding more. According to the U.K. consultancy UHY, China added 25 million new firms during the pandemic compared to 4.4 million in the United States.[3]

And China has technology. In a little more than a decade, China has surged into global leadership on many indicators ranging from patenting and robot stocks, to e-commerce sales, with many of its technology-based firms becoming household names worldwide. Lee (2021) describes the dynamic at the firm level in China: "Commercial applications are flourishing: a new wave of automation and AI infusion is crashing across a swath of sectors, combining software, hardware and robotics."

To be sure, the path to the technology frontier is challenging in the most sophisticated areas. As Naughton (2021) observes, with a few exceptions, China is not the science and technology leader in many of the component sectors of the fourth industrial revolution. The industrial policies being mounted in these areas are high risk, and success is not assured, particularly in the face of unprecedented U.S. technology export restrictions (Ernst, 2020). For example, China has struggled to get its commercial airline program running, missing yet another target for certification of COMAC's C919 commercial jetliner in 2021 (Meier, 2021). As well, notwithstanding the essentially limitless funding support behind the effort to de-Americanize China's computer chip production chain, China's firms remain well behind, and targets of reaching production at the key 14-nanometer level remain uncertain, especially in the face of continuously adjusted U.S. export restrictions (Lu, 2021). At the same time, China's concurrent success in various moonshot projects – the Mars rover, the Chang'e 5 mission to the moon, its own space station, and others – also underscores that this is not an economy that faces a glass ceiling on growth.

If economic growth is sustained at relatively high rates in real terms, as the considerations outlined above suggest, China's debt is sustainable and the various adjustments that China will need to make – such as shifting its infrastructure buildout from roads and rail to hospitals and childcare centres – will be financeable. China can build things – it was, after all, opening a university every week in the mid-2000-teens. And as Keynes famously said, "Anything we can actually do we can afford."

China may stumble in its rise, but don't hold your breath for demographics to be the stumbling block.

References:

Bowles, Ruthie. 2020. "Warehouse Robotics: Everything You Need to Know in 2019," Logiwa, 18 May.

Cai, Fang. 2010. "Demographic transition, demographic dividend, and Lewis turning point in China," China Economic Journal 3(2): 107-119. https://www.tandfonline.com/doi/abs/10.1080/17538963.2010.511899

Carrière, Yves and Diane Galarneau. 2011. “Delayed retirement: A new trend?,” Statistics Canada Catalogue no. 75-001-X, 26 October. https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=&ved=2ahUKEwipxNv_3pH1AhWMQc0KHWYEBN4QFnoECAUQAQ&url=https%3A%2F%2Fwww150.statcan.gc.ca%2Fn1%2Fpub%2F75-001-x%2F2011004%2Farticle%2F11578-eng.pdf&usg=AOvVaw3a2LzvxYOMor6-Mdl1Vb_g

Chen Mengni and Paul Yip. 2021. "China's population crisis: the country might grow old before it grows rich," South China Morning Post, 6 March. https://www.scmp.com/comment/opinion/article/3124139/chinas-population-crisis-country-might-grow-old-it-grows-rich

Cheng, Hong, Ruixue Jia, Dandan Li, and Hongbin Li. 2019. "The Rise of Robots in China," Journal of Economic Perspectives 33(2), Spring: 71–88.

Ciuriak, Dan. 2021. "Economic Doctrine is in Flux: What are the Implications for Canada's Regional and Multilateral Trade Engagement?" Notes for remarks at the Queen's Institute on Trade Policy 2021, Addressing Global Trade Challenges through Canada-United States Cooperation, 15 November 2021. https://papers.ssrn.com/abstract=3965977

Ciuriak, Dan and Maria Ptashkina. 2021a. "Technology Rents and the New Great Game," Book Chapter in Rahul Nath Choudhury (ed.), The China-US Trade War and South Asian Economies. Taylor & Francis/Routledge. https://www.routledge.com/The-China-US-Trade-War-and-South-Asian-Economies/Choudhury/p/book/9780367513818. Also available at SSRN: https://papers.ssrn.com/abstract=3663385

Ciuriak, Dan and Maria Ptashkina. 2021b. "Quantifying Trade Secret Theft: Policy Implications" CIGI Paper 253. Waterloo: Centre for International Governance Innovation. https://www.cigionline.org/publications/quantifying-trade-secret-theft-policy-implications Also available on SSRN as a Ciuriak Consulting Discussion Paper, 09 April 2021: https://papers.ssrn.com/abstract=3706511

Ciuriak, Dan and Vlada Rodionova. 2021. "Trading Artificial Intelligence: Economic Interests, Societal Choices and Multilateral Rules," Chapter 4 in Shin-Yi Peng, Ching-Fu Lin and Thomas Streinz (eds), Artificial Intelligence and International Economic Law: Disruption, Regulation, and Reconfiguration. Cambridge University Press: 70-93.

Ciuriak, Dan and Harvey Sims. 1980. Participation Rate and Labour Force Growth in Canada. Ottawa; Department of Finance (April 1, 1980). Available at SSRN: http://ssrn.com/abstract=1622898

Eberstadt, Nicholas. 2021. "The China Challenge: A Demographic Predicament Will Plague the Mainland for Decades," Discourse Magazine, 9 June. https://www.discoursemagazine.com/culture-and-society/2021/06/09/the-china-challenge-a-demographic-predicament-will-plague-the-mainland-for-decades/

Ernst, Dieter. 2020. "Competing in Artificial Intelligence Chips: China's Challenge amid Technology War, "Special Report, 26 March. Waterloo, ON: Centre for International Governance Innovation. https://www.cigionline.org/publications/competing-artificial-intelligence-chips-chinas-challenge-amid-technology-war/

Fields, Andrew, Sharanjit Uppal, and Sébastien LaRochelle-Côté. 2017. “The impact of aging on labour market participation rates,” Statistics Canada, Catalogue no. 75-006-X, 14 June. https://www150.statcan.gc.ca/n1/pub/75-006-x/2017001/article/14826-eng.htm

Feng, Qiushi, Wei-Jun Jean Yeung, Zhenglian Wang, and Yi Zeng. 2019. "Age of Retirement and Human Capital in an Aging China, 2015–2050," European Journal of Population 35: 29–62. https://doi.org/10.1007/s10680-018-9467-3

Hua Xia. 2021. "China will raise retirement age gradually: expert," Xinhua, 12 March. http://www.xinhuanet.com/english/2021-03/12/c_139806275.htm

Kruger, Mark. 2021. "Is China Facing a Demographic Crisis?" Yicai, 01, June. https://www.yicaiglobal.com/opinion/mark.kruger/is-china-facing-a-demographic-crisis

Lee, Kai-Fu. 2021. "China Is Still the World's Factory—And It's Designing the Future With AI," Time, 11 August. https://time.com/6084158/china-ai-factory-future/

Li, Hongbin, Prashant Loyalka, Scott Rozelle, and Binzhen Wu. 2017. "Human Capital and China's Future Growth," Journal of Economic Perspectives 31(1), Winter: 25–48.

Liu, Deqiang. 2015. "Has the Chinese economy passed the Lewis turning point?" Journal of the Asia Pacific Economy 20(3): 404-422. https://www.tandfonline.com/doi/abs/10.1080/13547860.2015.1054167

Lu, Misha. 2021. "Chinese Chip Industry Has a Plan B, and Now U.S. Sanctions Are Catching Up," TechTaiwan, 13 December. https://techtaiwan.com/20211213/samsung-umc/

Mehrotra, Neil R. and Dmitriy Sergeyev. 2021. "Debt Sustainability in a Low Interest Rate World," Journal of Monetary Economics 124, Supplement, November: S1-S18.

Meier, Ricardo. 2021. "Certification of COMAC C919 jetliner is postponed to 2022," Air Data News, 8 December. https://www.airway1.com/certification-of-comac-c919-jetliner-is-postponed-to-2022/

Naughton, Barry. 2021. The Rise of China’s Industrial Policy, 1978-2020. Universidad Nacional Autónoma de México.

Pieke, Frank N., Björn Ahl, Elena Barabantseva, Michaela Pelican, Tabitha Speelman, Wang Feng, and Xiang Biao. 2019. "How immigration is shaping Chinese society," China Monitor, Mercator Institute for China Studies (MERICS), 27 November. https://merics.org/en/report/how-immigration-shaping-chinese-society

Qi, Jing. 2021. "How China has been transforming international education to become a leading host of students," The Conversation, 12 May. https://theconversation.com/how-china-has-been-transforming-international-education-to-become-a-leading-host-of-students-157241

Rachman, Gideon. 2021. "Lousy demographics will not stop China's rise," The Economist, 3 May. https://www.ft.com/content/ae51b1bf-4c45-4c8b-8e41-16d2112bc549

Siegel, Christian. 2017. "Female relative wages, household specialization and fertility," Review of Economic Dynamics 24, March: 152-174. https://www.sciencedirect.com/science/article/pii/S1094202517300194

Tatum, Megan. 2021. "China's three-child policy," The Lancet 397(10291), P2238. 12 June. DOI: https://doi.org/10.1016/S0140-6736(21)01295-2

The Economist. 2021. "China will raise retirement age gradually: expert," The Economist, 24 June. https://www.economist.com/china/2021/06/22/chinas-average-retirement-age-is-ridiculously-low-54

Turner, Adair. 2021. "The Upside of Population Decline," Project Syndicate, 10 June. Project Syndicate

Wee, Sui-Lee. 2021. "China's 'Long-Term Time Bomb': Falling Births Stunt Population Growth," The New York Times, 10 May. https://www.nytimes.com/2021/05/10/china-census-births-fall.html

Zhang, Zoey. 2021. "China Releases Supporting Measures for Three-Child Policy," China Briefing, Dezan Shira and Associates, 22 July. https://www.china-briefing.com/news/china-releases-supporting-measures-for-three-child-policy/

Endnotes:

[1] Note that the two effects sum to 105% and thus actually over-account for the per capita income growth. This reflects a technical feature of the analysis, namely a shift in the regression line. For practical purposes, the study suggests that essentially 100% of China’s historical per capita income growth was accounted for by increased educational attainment and the improved use of this human capital in the market.

[2] This dynamic can be inferred from the trend towards restrictive covenants to prevent trade secret leakage and the rise of trade secret litigation, which mostly is centered on inter-firm employee mobility. See Ciuriak and Ptashkina (2021b) for a discussion of this issue.

[3] https://www.uhy.com/china-created-1-25-million-more-new-businesses-during-covid-pandemic-leading-the-world-in-new-business-creation/